Dealing with taxes in Spain as an American can be quite the adventure- As a US citizen, you’re in a unique position. You’ve got to navigate the tax rules of both countries and let’s be honest, that can feel a bit overwhelming.

The good news? It’s not as daunting as it sounds. This guide is here to walk you through the essentials of Spanish taxation for U.S. expats. From understanding double taxation to figuring out those tax filing deadlines, we cover it all.

So, let’s get down to business and demystify these tax rules, shall we? It’s all about staying informed and prepared – and we’re here to help with just that!

Table of contents

Taxes in Spain as an American: A Dual Responsibility

As an American who’s made the move to Spain, here’s something important: you need to file taxes both in Spain and back home with the IRS. Why? Because the U.S. taxes its citizens on their income, no matter where they live.

U.S. Spain Tax Treaty

But don’t stress too much about it. The U.S. and Spain have an agreement to help prevent you from being double taxation on the same income. This makes handling your taxes a bit easier and keeps you from paying more than you should.

Tax in Spain for Expats: Who needs to pay?

So, what are the particular requirements for paying tax in Spain as an expat? Here’s what you need to know about when to file a Spanish Income Tax Return:

- Income from Spanish Sources: If your income from sources within Spain exceeds €22,000, it’s time to file a tax return. This is Spain’s way of keeping track of your financial contributions.

- Income from Outside Spain: Even if you earn less than €22,000 in Spain, but have income from abroad, you’ll need to include that in your tax return. Spain looks at your global income, not just what you earn locally.

- Specific Limits for Certain Incomes: There are some exceptions. If your income from investments or capital gains is below €1,600, or your income from real estate and treasury bills is under €1,000, you might not need to file for those.

- Non-Resident Tax Rules: If you’re in Spain for less than 183 days in a year, you will pay tax only on your Spanish-sourced income. Your income from outside of Spain is not subject to taxation.

- Filing Deadline: Remember, the deadline for filing your personal income tax is June 30th of the following year. So, for taxes from 2023, the deadline is until June 30th, 2024.

In essence, the key to managing all this is keeping an eye on your time spent in the country and understanding your worldwide income. By doing so, you can ensure a smooth financial transition to your new Spanish lifestyle.

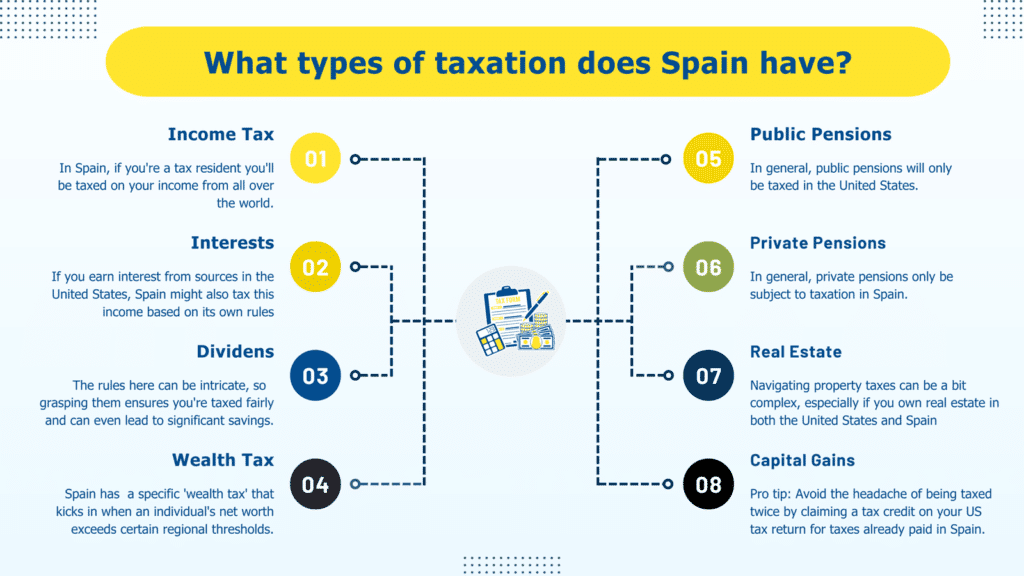

What Types of Taxation Does Spain Have?

In Spain, if you’re a tax resident, meaning you live here most of the year, you will pay tax on your income from all over the world. The rates for this kind of tax are progressive, which means the more you earn, the higher the percentage of tax you pay.

These rates aren’t the same everywhere in Spain – they vary by region. For instance, in Catalonia, the starting rate is currently 20% for income up €12,450, hitting 50% for income above €300,000.

Now, if you’re a non-resident – maybe you live here only part of the year – things are a bit different. You’ll only be taxed on the income you make in Spain, and it’s a flat rate of 24%. That means no matter how much you earn in Spain, the tax rate stays the same.

Does Spain Tax US Pensions?

In Spain, US pensions are seen as income from past employment. The way they’re taxed depends on whether the pension is from a public (government) job or a private sector job. Here’s how each type is handled for tax purposes:

Public pension

Public pensions, received from past government employment, are treated as follows for tax purposes:

- Taxed Mainly in the U.S.: Typically, public pensions are only taxed in the United States and are exempt in Spain. However, this exemption in Spain doesn’t completely exclude the pension from your tax calculations. If you file a Spanish tax return for other types of income, the exempt pension amount is still considered when determining your tax rate for that additional income.

- Exception for Spanish Nationals: If you are a Spanish national living in Spain and receiving a public pension, it’s a different situation. In this case, your pension is taxed only in Spain, not in the U.S.

Private Pension

A private pension, originating from past private sector employment, is typically handled as follows for tax purposes:

- Primarily Taxed in Spain: Generally, private pensions are subject to taxation in Spain.

- U.S. Taxation Under Specific Circumstances: There’s an exception for payments under the U.S. Social Security system. If you’re a resident of Spain or a U.S. citizen receiving such payments, they may be taxed in the U.S. In these cases, you can claim a deduction in Spain for international double taxation, as long as the income was taxed in the U.S. for reasons other than just citizenship.

Check our latest Guide for an incredibly easy retirement in Spain.

Interests in Spain

If you earn interest from sources in the United States, Spain might also tax this income based on its own rules. Here’s how Spain taxes this kind of interest income:

| Tax Base | Tax Rate | |

| From | To | |

| 0€ | 6.000€ | 19% |

| 6.000€ | 44.000€ | 21% |

| 50.000€ | 200.000€ | 23% |

| 200.000€ | – | 26% |

Regarding interest income, there’s a bit to juggle between the U.S. and Spain. If you’re earning interest, the U.S. might tax it according to its laws. But, if you’re living in Spain and are a resident here, the U.S. tax on this interest can’t be more than 10% of the total interest you earned.

Good news for those living in Spain: you can get a tax break to avoid double taxation on the same interest income. Spain allows you to deduct some of this U.S. tax from what you owe in Spain, which helps keep things fair and balanced.

Capital Gains Tax in Spain

Let’s talk capital gains tax in Spain – this is the profit you get when you sell assets like stocks or property. In the U.S., the length of time you hold an asset before selling it really matters for taxes. If you’ve held onto an asset for more than a year, you’re in luck. The tax rates are quite appealing, ranging from 0% to 20%, depending on your total income.

Switch over to Spain, and it’s a different story. Here, it doesn’t matter how long you’ve had the asset; any capital gains are taxable. These gains fall into the ‘savings income’ category, which includes dividends and interest. The tax rates? They’re in line with those for interest income, which we touched on earlier.

For non-residents earning capital gains in Spain, the rules are straightforward – there’s a flat tax rate of 24%. If you’re selling shares in Spanish companies, expect to pay taxes in Spain. But if your gains are from selling shares in U.S. companies, the U.S. gets dibs on taxing those.

And here’s a pro tip: To avoid the headache of being double taxation, you can claim a tax credit on your U.S. tax return for the taxes you’ve already paid in Spain.

Exceptions for Capital Gains tax in Spain

Good news for homeowners in Spain: You can get a break on capital gains tax when you sell your home and reinvest the profit into buying another property in Spain. How does it work? Basically, the portion of your sale’s profit that you use to buy the new property can be exempt from capital gains tax.

For example, say you sell your home and use half of that money to buy a new place. The tax on your profit from the sale will be cut by 50%. But, there are some key rules to qualify for this tax break:

- The property you sold needs to have been your main home for at least 2 years prior to the sale.

- You must buy the new property in Spain within two years of selling the old one.

- Move into your new home within 12 months of buying it.

- Live in your new home for at least 3 years after purchase.

Following these steps can significantly reduce your tax bill when you move from one home to another in Spain.

Dividends

As an American expat in Spain, it’s crucial to understand how dividends from U.S. companies are taxed. The rules can be intricate, but grasping them ensures you’re taxed fairly and can even lead to significant savings. Let’s break down these tax considerations:

- Taxation in Both Countries: Dividends from U.S.-based companies might be taxed in both Spain and the U.S. In Spain, they follow Spanish tax rules. In the U.S., the tax depends on the location of the company distributing the dividends.

- Cap for Spanish Residents: For those living in Spain, there’s a favorable tax cap. The U.S. tax on your dividends won’t exceed 15% of the total dividend amount.

- Avoiding Double Taxation: As a resident in Spain, you have an advantage. You can claim a deduction for the tax already paid in the U.S., lowering your tax liability in Spain. This helps avoid paying tax twice on the same income.

- Tax Rules in Spain: The way Spain taxes these dividends is similar to how it taxes interest income, detailed in the earlier section.

Property Taxes in Spain

Navigating property taxes in Spain can be a bit complex, especially if you own real estate in both the United States and Spain. Here’s what American expats need to know:

- Taxation on U.S. Properties: If you own real estate in the U.S., be prepared for potential taxation in both countries. In Spain, you can claim a deduction to offset this, thanks to international double taxation agreements. This means you can reduce your Spanish tax liability by the amount already paid in the U.S.

- Tax on Spanish Properties: Owning property in Spain comes with its own tax rules. For instance, if you have apartments in Spain, even if you don’t rent them out, they’re still subject to tax. The government considers this ‘imputed income’, which is 1.1% of the property’s official value, known as the cadastral value.

- No U.S. Tax Credit for Imputed Income: It’s important to note that this imputed income tax in Spain doesn’t come with the option to claim a credit on your U.S. taxes. So, the tax paid in Spain on these properties is exclusive to Spain.

Understanding these nuances helps ensure you’re compliant with tax obligations in both countries and can plan your finances more effectively.

Wealth Tax in Spain

Spain’s approach to taxing wealth is distinct from that of the United States, involving a specific ‘wealth tax’ that kicks in when an individual’s net worth exceeds certain regional thresholds.

Here’s a breakdown to help you understand:

- Regional Thresholds for Wealth Tax: The amount at which the wealth tax applies varies across Spain’s autonomous regions. For example, in Catalonia, the threshold is €500,000, in Andalusia and the Balearic Islands, it’s €700,000, and in Valencia, it’s €600,000. Interestingly, Madrid stands out as the only region completely exempting the wealth tax.

- Tax Rates for Residents and Non-Residents: Regardless of whether you’re a resident or a non-resident, if you own assets in Spain that exceed the regional threshold, you’ll be subject to the wealth tax. The rates for this tax range from 0.2% to 2.5%.

- Avoiding Resident Status for Tax Purposes: If you’re in Spain for up to 183 days and wish to avoid being classified as a tax resident, you need to officially declare your tax residency in another country. All you have to do is provide a certificate of tax residency to the Spanish Tax Authorities for the relevant tax year.

- Reporting Requirements for Foreign Assets: There’s also a reporting obligation for certain foreign assets. If you own assets outside of Spain worth more than €50,000, you need to file Form 720. This form covers various asset categories, including bank accounts, real estate, shares, investments, pension plans, and insurance located outside of Spain.

Understanding these aspects of Spain’s wealth tax is crucial for effective financial planning, especially if your assets span across different countries.

Frequently Asked Questions

Does the US have a tax treaty with Spain?

Yes! The U.S. and Spain have a long-standing tax treaty, updated 35 years ago, which helps U.S. expats avoid double taxation. By claiming U.S. tax credits equal to the Spanish income taxes paid, expats can prevent paying taxes twice on the same income.

Do US expats in Spain also have to file taxes in America?

Yes, as an American citizen or permanent resident living in Spain, it’s mandatory to file expatriate tax returns with the U.S. federal government annually, regardless of whether you owe any U.S. taxes.

When are Spain’s taxes due?

In Spain, the typical deadline to file and pay your taxes is from April 11th to June 30th for the previous tax year. A ministerial order sets this time timeframe manually and it usually concludes on June 30th.

Are there any important forms I need to complete as a US resident in Spain?

Americans living in Spain need to be aware of several key tax forms for Spanish tax authorities:

- Modelo 100: For tax residents in Spain to report worldwide income, due by July 30th without extensions.

- Modelo 150: For reporting income sourced in Spain, typically filed quarterly by non-residents.

- Modelo 210: For non-residents owning Spanish property, to report and pay “deemed” income tax, due by December 31st of the following tax year.

- Modelo 720: For residents with assets outside Spain over EUR 50,000, due by March 31st.

How can Lexidy Help?

Your tax situation in Spain, whether you’re working on a contract, a tax resident, running a business, or involved in digital services, is unique. Don’t let the complexity overwhelm you.

At Lexidy, we specialize in simplifying Spanish taxes for Americans. Reach out to our tax experts by filling out the form below and let us streamline your tax process.