Buying property in Portugal as a foreigner has become increasingly popular in recent years, thanks to the country’s warm climate, affordable cost of living, and attractive tax benefits. From retirees and remote workers to investors and families, people from around the world are choosing Portugal for its stability, safety, and high quality of life.

But purchasing real estate in a foreign country requires careful planning. There are legal steps, financial requirements, and property taxes that buyers need to understand before moving forward.

This guide explains how to buy a home in Portugal, what it will cost, the financing options available to non-residents, and why legal guidance is essential at every step.

(Article Updated June 2025)

Why Foreigners Are Buying Property in Portugal

Portugal continues to attract a growing number of international property buyers, and for good reason. Whether it’s for relocation, investment, or retirement, the country offers a compelling mix of lifestyle and financial advantages.

Lifestyle Appeal

Portugal is known for its warm climate, with more than 300 days of sunshine each year in many regions. Residents enjoy a healthy Mediterranean diet, access to nature, and a laid-back pace of life.

The country ranks among the safest in Europe and offers high-quality public and private healthcare systems. Education options are strong, and the culture is welcoming, especially to English-speaking foreigners and digital nomads.

Real Estate Trends

Portugal’s real estate market remained resilient through 2024 and is showing positive momentum in 2025. According to CBRE, investment volumes are expected to grow by 8%, reaching €2.5 billion this year. Lower interest rates and improved financing conditions are making it easier for buyers to move forward with purchases.

The retail and hotel sectors continue to lead investment activity, fueled by Portugal’s strong tourism recovery and urban growth. In the residential market, foreign buyers remain a major force, especially in Lisbon, Porto, and the Algarve.

There is also increasing interest in Tier 2 cities, where better value and rising rental yields are attracting long-term investors.

Popular Areas for Foreign Buyers

- Lisbon: Portugal’s capital offers a mix of old-world charm and modern infrastructure, making it ideal for professionals, investors, and families.

- Porto: A northern coastal city known for its wine, culture, and growing tech sector.

- Algarve: A top choice for retirees and second-home buyers looking for beach access and expat communities.

- Silver Coast: A scenic and less touristy stretch of coastline gaining interest for its affordability and quality of life.

Exploring real estate options in Portugal? Get legal support for your property purchase

How to Buy Property in Portugal as a Foreigner

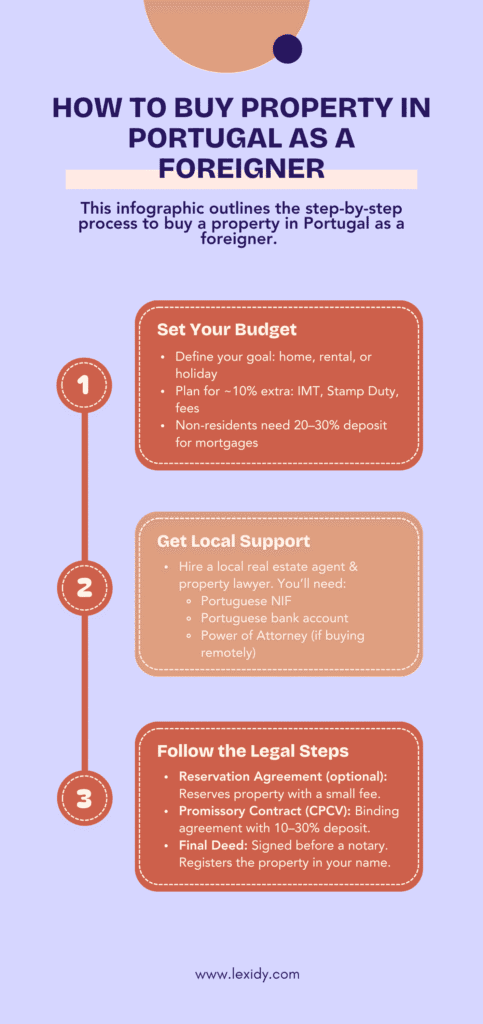

Foreign nationals face no legal restrictions when purchasing real estate in Portugal. But to ensure a smooth and secure transaction, it’s essential to understand each stage of the process, from planning your budget to signing the final deed. Here’s how to buy property in Portugal as a foreigner:

1. Set Your Budget and Financing Plan

Before starting your property search, it’s important to define your investment goals. Are you buying a permanent residence, a vacation home, or a rental property? This will influence both location and budget.

In addition to the purchase price, you should plan for around 10% in additional costs, including:

- Property Transfer Tax (IMT).

- Stamp Duty (Imposto do Selo).

- Notary and land registration fees.

- Legal and administrative expenses.

If you need financing, you can explore mortgage options for non-residents, although most Portuguese banks will require a minimum deposit of 20% to 30%. Planning ahead is key to understanding how to buy property in Portugal as a foreigner without surprises.

2. Work With Real Estate and Legal Experts

Local expertise is essential. A reliable real estate agent can help you find properties that match your goals, while a property lawyer ensures all legal aspects are reviewed and managed properly.

To proceed with the purchase, you’ll need:

- A Portuguese tax identification number (NIF)

- A Portuguese bank account for payments and transfers

If you’re buying remotely, a Power of Attorney can authorize your lawyer to sign contracts and complete the purchase on your behalf

Having the right professionals in place protects your interests and simplifies the process, especially if you’re not in Portugal during the transaction.

3. Legal Process to Buy a House

Once you’ve selected a property, the legal purchase process follows three main steps:

- Reservation Agreement (optional): A simple agreement used to temporarily reserve the property while contracts are prepared. Usually involves a small fee.

- Promissory Contract (Contrato de Promessa de Compra e Venda – CPCV): This is the main binding agreement between buyer and seller. It includes key terms such as the purchase price, payment schedule, timeline, and penalties for withdrawal. A deposit of 10% to 30% is typically paid at this stage.

- Final Deed (Escritura Pública de Compra e Venda): The sale is completed by signing the final deed before a notary. The property is then officially registered in your name with the Land Registry and Tax Office.

A full legal review is essential at every stage. Your lawyer will verify ownership, debts, licenses, and zoning restrictions. A technical inspection by an engineer is also strongly recommended to assess the property’s condition. Have questions? Reach out using the form below for a free consultation.

Property Taxes in Portugal for Foreigners

When buying property in Portugal as a foreigner, it’s important to understand the different taxes and legal costs involved. These are paid at different stages of the process, some during the purchase, and others on an ongoing basis after the transaction is complete.

IMT (Municipal Property Transfer Tax)

The IMT (Imposto Municipal sobre Transmissões Onerosas de Imóveis) is a one-time tax paid at the time of purchase. It applies to all real estate transactions in Portugal and is calculated based on the higher of the declared purchase price or the tax-assessed value of the property.

Rates vary depending on whether the home will be a primary or secondary residence, and whether it’s urban or rural. IMT is calculated using a sliding scale:

- Primary residence: Rates start at 0% for properties under €97,064 and can go up to 8% for luxury properties.

- Secondary residence (or investment properties): Tax rates apply sooner and increase more steeply.

Certain exemptions or reductions may apply for first-time buyers or properties below a certain value.

Stamp Duty

Stamp duty (Imposto do Selo) is another tax due at the time of purchase. It is set at:

- 0.8% of the property price for all real estate purchases.

- An additional 0.6% applies if you take out a mortgage to finance the purchase.

Your notary or lawyer will calculate this amount and ensure it is paid before the deed is signed.

IMI (Municipal Property Tax – Annual)

The IMI (Imposto Municipal sobre Imóveis) is a recurring annual tax paid by all property owners in Portugal. It is calculated based on the tax-assessed value (VPT) of the property, not the market value.

Rates vary depending on the municipality:

- Urban properties: 0.3% to 0.45%.

- Rural properties: 0.8%.

Each local authority sets its own IMI rate. Some municipalities offer temporary IMI exemptions for new builds, low-income families, or energy-efficient homes. Your lawyer can check if any exemptions apply to your case.

Notary and Legal Fees

Notary fees vary by region and the value of the property but typically range from €500 to €1,200.

Lawyer fees may be charged as a fixed amount or as a percentage of the purchase price. These fees cover document review, legal due diligence, contract drafting, and registration services.

Having a qualified lawyer ensures you understand your obligations around property taxes in Portugal for foreigners and helps you avoid costly mistakes or delays.

Portugal Mortgage Rates for Foreigners

Financing a property in Portugal as a non-resident is possible and increasingly common. While Portugal’s mortgage rates for foreigners may differ slightly from those offered to residents, many banks provide competitive options if you meet certain conditions.

Can Foreigners Get a Mortgage in Portugal?

Yes, most Portuguese banks offer mortgage loans to non-resident buyers. However, lending decisions are based on the applicant’s risk profile, income, and financial stability.

Foreign buyers must meet the bank’s Know Your Customer (KYC) and anti-money laundering (AML) requirements. This typically includes providing proof of identity, income, employment, credit history, and tax residency. Self-employed buyers may need to show additional documentation such as company accounts or tax returns.

Each bank has its own internal policy for non-resident borrowers, so it’s helpful to work with a mortgage broker or legal advisor who knows the market.

Mortgage Conditions

Portugal’s mortgage rates for foreigners usually include the following terms:

- Loan-to-value ratio (LTV): Most banks finance 60% to 70% of the property’s purchase price or valuation, whichever is lower.

- Loan term: Terms of up to 30 years are available, though shorter terms may apply based on the borrower’s age and financial profile.

- Interest rates: Borrowers can choose between fixed and variable rates, with variable rates typically tied to the Euribor index plus a spread.

Foreign buyers should also be aware that interest rates and approval timelines may vary depending on the bank and property type.

Mortgage Costs

Taking out a mortgage in Portugal comes with a few additional costs:

- Stamp duty: A 0.6% tax applies to the loan amount.

- Bank fees: These may include charges for application, loan opening, property appraisal, and document processing. Fees vary but can range from €500 to €2,000 in total.

Insurance

- Fire insurance is mandatory and must be maintained for the life of the loan.

- Life insurance is often recommended but not legally required.

Your lawyer can help you compare options and estimate the full cost of financing based on your personal situation. Want to explore your mortgage options further? Check out this guide to getting a mortgage in Portugal as a foreigner.

Common Mistakes to Avoid When Buying Property in Portugal as a Foreigner

Buying property in Portugal as a foreigner is straightforward, but certain missteps can lead to delays, extra costs, or legal issues. Here are the most common mistakes to watch for:

Buying Without a Lawyer

Relying only on an agent or online listing can expose you to hidden risks. A lawyer ensures the property is registered, free of debts, and legally suitable for your plans.

Misunderstanding Tax and Mortgage Terms

Portugal’s taxes and mortgage costs can be complex. Misreading these terms often leads to budget gaps or loan issues. Always get professional advice on financing and tax obligations before committing.

Skipping Planning and Legal Checks

Some properties come with zoning restrictions or illegal construction. Your lawyer should verify land registry records, licenses, and planning compliance before any contracts are signed.

Ignoring Ongoing Costs

Beyond the purchase price, buyers should plan for annual IMI, insurance, and maintenance. These recurring costs can be significant, especially in shared buildings or tourist areas.

Want to avoid costly mistakes? Get legal clarity on buying property in Portugal.

Legal Help for Foreigners Buying Property in Portugal

The Portuguese property system is buyer-friendly, but legal guidance is still essential, especially if you’re purchasing from abroad or don’t speak the language fluently. A qualified property lawyer ensures your investment is secure, compliant, and aligned with your goals.

What a Property Lawyer Does

From the first document to the final deed, your lawyer:

- Obtains your Portuguese tax number (NIF).

- Reviews the legal status of the property and land registry.

- Drafts or reviews all contracts, including the promissory contract (CPCV).

- Coordinates with notaries, tax authorities, and real estate agents.

- Ensures taxes and fees are paid correctly and on time.

- Registers the property in your name after purchase.

Language and Remote Support

For non-Portuguese speakers or buyers abroad, legal assistance becomes even more valuable. Your lawyer can act on your behalf via Power of Attorney, handle translations, and keep you updated throughout the process. This allows you to complete the transaction without being physically present in Portugal.

How Lexidy Supports International Buyers

Lexidy’s property lawyers are experienced in helping foreign clients navigate every stage of the purchase process. From securing documents to reviewing contracts, the team works across languages and time zones to simplify each step, giving you peace of mind whether you’re buying your dream home or making an investment.

Ready to Buy a Property in Portugal as a Foreigner?

Buying property in Portugal as a foreigner is more accessible than ever, with no restrictions on ownership, competitive mortgage options, and a stable, growing real estate market. Whether you’re relocating, investing, or purchasing a second home, Portugal offers a high quality of life and long-term value.

To make the process smooth and secure, it’s essential to plan ahead. Understanding your tax obligations, financing options, and legal requirements early on will save time and avoid surprises later.

Working with experienced legal professionals ensures your property is properly reviewed, registered, and protected, especially if you’re buying from abroad.

Whether you’re ready to buy or still exploring, our property lawyers in Portugal are here to help. Fill out the form below to get started!