Starting a company in Spain is an exciting opportunity, but it can also feel overwhelming when you are faced with new rules and paperwork. The reward, however, is building your business in one of Europe’s most attractive destinations, with its lifestyle, culture, and access to the EU market.

This guide explains the key steps to starting a company in Spain as a foreigner. You’ll learn about legal structures, registration, taxes, and compliance, with practical tips to help you prepare.

The goal is simple: give you the clarity and confidence to build your business while knowing when professional guidance can make the process smoother.

Table of Contents

- Why Start a Company in Spain?

- Choosing Your Company Type in Spain

- Essential Requirements for Starting a Company in Spain as a Foreigner

- Step-by-Step Process for Starting a Company in Spain

- Costs Involved in Starting a Company in Spain

- Common Mistakes and Challenges for Foreigners

- Frequently Asked Questions About Starting a Company in Spain

- Need Support with Starting a Company In Spain?

Why Start a Company in Spain?

Spain has become one of Europe’s most appealing places to launch a business. It’s not just about the sunshine and lifestyle; there are strong practical reasons, too:

- Access to the EU Market: Starting a company in Spain gives you entry into the wider European Union, opening doors to over 400 million consumers.

- Skilled Workforce: Spain has a large pool of educated professionals, especially in sectors like tech, engineering, and services.

- Favorable Business Environment: While bureaucracy exists, Spain is consistently improving its systems for entrepreneurs and offers competitive corporate tax rates.

- Quality of Life: A safe environment, excellent healthcare, and affordable cost of living make Spain not just a good place to do business, but also a good place to live.

- Growing Startup Ecosystem: Cities like Barcelona, Madrid, and Valencia are building strong reputations as hubs for innovation, attracting investors and entrepreneurs from across the globe.

Starting a company in Spain means building your professional future in a country that balances opportunity with quality of life. It’s a practical business decision with lifestyle benefits that few other European countries can match.

Can foreigners open a company in Spain? Find out who qualifies and how our lawyers help.

Choosing Your Company Type in Spain

When starting a company in Spain, choosing the right legal structure shapes your taxes, liability, and how your business grows. Here are the main options:

| Type | Ownership | Liability | Taxation | Setup Complexity | Minimum Capital |

| Freelancer (Autónomo) | Single individual | Unlimited personal liability | Taxed as personal income | Simple and low-cost | No requirement |

| Limited Liability Company (SL – Sociedad Limitada) | One or more shareholders | For shareholders limited to share capital invested | Corporate tax rate | Formal registration required | Minimum: €3,000 |

| Subsidiary (SL) | Local legal entity owned by aparent company | Limited to share capital invested in the subsidiary | Corporate tax rate | Formal registration required, treated as a separate legal entity (independent SL) | Minimum: €3,000 |

| Branch Office (Sucursal) | Not a separate entity – extension of the parent company | Parent company holds full liability | Corporate tax rate | Formal registration required, treated as an extension of the parent company in Spain | No fixed minimum, but must allocate operational funds |

Limited Liability Company (Sociedad Limitada – SL)

The SL is the most popular choice for small and medium-sized businesses in Spain. It offers flexibility and protects personal assets.

- Minimum Share Capital: €3,000 (must be deposited after incorporation).

- Shareholders: At least 1, can be individuals or companies.

- Liability: Limited to the company’s assets. Personal assets are generally protected.

- Management: Run by the management body, formed by directors or a board of directors.

- Best For: Entrepreneurs and SMEs looking for growth while limiting personal risk. Also good for bigger companies that do not want to go public.

Freelancer (Autónomo)

The simplest option for solo entrepreneurs and freelancers. It requires little setup but carries higher personal risk.

- Minimum Share Capital: None.

- Ownership: Single individual.

- Liability: Unlimited personal liability.

- Management: Self-managed, with social security contributions required.

- Best For: Freelancers or very small ventures just starting out.

Subsidiary (SL)

A subsidiary is an independent company in Spain owned by a foreign parent. It operates like an SL and provides more separation from the parent company.

- Minimum Share Capital: €3,000.

- Ownership: Parent company is the shareholder.

- Liability: Limited to the subsidiary’s assets.

- Management: Managed locally under Spanish law.

- Best For: Foreign businesses wanting a permanent, independent presence in Spain.

Branch Office (Sucursal)

A branch is an extension of a foreign company rather than a separate entity. The parent company remains fully liable for its operations in Spain.

- Minimum Share Capital: None, but operational funds must be allocated.

- Ownership: Fully owned by the parent company.

- Liability: Parent company holds full liability.

- Management: Operates under the parent company’s control. A representative must be named in Spain, who must be a Spanish resident.

- Best For: Companies testing the Spanish market or running limited operations.

Public Limited Company (Sociedad Anónima – SA)

The SA is designed for large businesses, especially those planning to raise investment or go public.

- Minimum Share Capital: €60,000 (25% paid at incorporation).

- Shareholders: At least 1, though typically many. Shares can be traded.

- Liability: Limited to the company’s assets.

- Management: Requires a board of directors and stricter governance.

- Best For: Large enterprises or companies planning external investment or to go public.

Want to avoid costly mistakes? Get legal clarity on starting a company in Spain.

Essential Requirements for Starting a Company in Spain as a Foreigner

Before registering your company, there are a few key requirements every foreign entrepreneur should prepare for:

NIE / NIF

All shareholders and directors must have a Spanish identification number:

- NIE (Número de Identificación de Extranjero): Required if the shareholder or director is an individual. This is obtained through the Immigration Police.

- NIF (Número de Identificación Fiscal): Required if the shareholder is another company. This is obtained through the Spanish Tax Agency.

Bank Account

A Spanish business bank account is needed to deposit the company’s share capital after incorporation.

Registered Office

Your company must have a registered address in Spain. This can be a physical office, co-working space, or virtual office, but it must be within Spanish territory and used for official correspondence.

Share Capital

The required minimum depends on the chosen structure:

- SL (Sociedad Limitada): €3,000.

- SA (Sociedad Anónima): €60,000.

- Subsidiary (SL): €3,000 (treated as an independent SL in Spain, owned by the foreign parent).

- Branch: No fixed minimum, but operational funds must be allocated.

- Autónomo: No share capital required.

Legal Representation

If foreign companies, which are shareholders or directors, are non-residents, a legal representative in Spain must be appointed to handle notifications and official obligations. A NIE number will be obtained for the legal representative.

Tax Obligations

Once incorporated, your company will be registered with Spanish tax authorities and subject to:

- Corporate Income Tax (CIT): Standard rate is 25% (applies to SL, SA, Subsidiary, and Branch).

- VAT (IVA): Generally 21%, with reduced rates in some cases.

- Social Security Contributions: Required for employees, autónomos, and, in some cases, directors.

- Autónomo Taxation: Freelancers are taxed through personal income tax (IRPF), which is progressive from 19% to 47% depending on income level, instead of corporate tax.

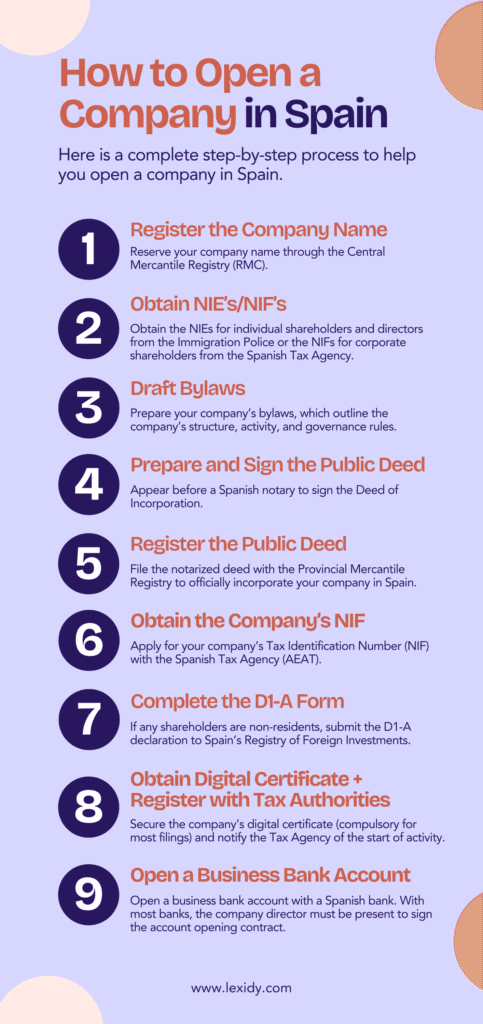

Step-by-Step Process for Starting a Company in Spain

Starting a company in Spain involves several legal and administrative steps. Here’s a breakdown of the process so you know exactly what to expect:

1. Register the Company Name

Reserve your company name through the Central Mercantile Registry (RMC). The name must be unique and distinguishable from existing businesses.

Timeline: 2 days

2. Obtain the NIEs or NIFs for Shareholders and Directors

- NIE: Required for individuals. Obtained from the Immigration Police.

- NIF: Required for corporate shareholders. Obtained from the Spanish Tax Agency.

This step can take time, so start early.

Timeline: 1 week to 3 months

3. Draft Bylaws

Prepare your company’s bylaws, which outline the company’s structure, activity, and governance rules. These are essential for legal incorporation.

Timeline: 2–3 days

4. Prepare and Sign the Public Deed

Appear before a Spanish notary to sign the Deed of Incorporation. This document includes your bylaws, shareholder details, and other founding information.

Timeline: 5–7 days

5. Register the Public Deed

File the notarized deed with the Provincial Mercantile Registry to officially incorporate your company in Spain.

Timeline: 20–25 days

6. Obtain the Company’s NIF

Apply for your company’s Tax Identification Number (NIF) with the Spanish Tax Agency (AEAT). This is required to start business operations.

Timeline: 1 day

7. Complete the D1-A Form

If any shareholders are non-residents, submit the D1-A declaration to Spain’s Registry of Foreign Investments.

Timeline: 1 day

8. Obtain the Digital Certificate and Register with Tax Authorities

Secure the company’s digital certificate (compulsory for most filings) and notify the Tax Agency of the start of activity.

Timeline: 3–4 days

9. Open a Business Bank Account

Open a business bank account with a Spanish bank. With most banks, the company director must be present to sign the account opening contract.

Timeline: 7 days to 3 weeks

Opening a company in Spain can take between 4 and 8 weeks when documents are in order. The main delays come from obtaining NIEs/NIFs and processing at the Mercantile Registry. Missing paperwork or translation issues can slow things down, so careful preparation is key to keeping things on track.

Costs Involved in Starting a Company in Spain

Aside from share capital, there are several other costs to budget for when starting a company in Spain:

- Notary Fees: €400-€1,000, depending on company type and document length.

- Commercial Registry Fees: €200-€400 for registering the deed of incorporation.

- Legal and Administrative Support: €1,000-€5,000 if working with professionals to handle the setup.

- Certified Translations: €30-€50 per page for documents not originally in Spanish.

- Apostille or Legalization: depending on the country, generally €200-€300 per document to make foreign documents valid in Spain.

Common Mistakes and Challenges for Foreigners

Starting a company in Spain can feel unfamiliar if you are not used to the local system. Here are some of the most common pitfalls, and how to avoid them:

Lack of Understanding of Spanish Bureaucracy

Spain has a reputation for paperwork and multiple administrative steps. Missing even a small detail can cause long delays.

Tip: Be prepared for extra forms and signatures, and factor in time for approvals. Having a professional guide you through each stage can make the process smoother.

Incorrectly Prepared Documentation

Errors in translated documents, missing apostilles, or inconsistent details between forms often lead to rejections.

Tip: Double-check that all documents are complete, correctly translated into Spanish, and certified where required.

Underestimating Timelines

Even though some steps are quick, incorporation as a whole can take weeks. Administrative backlogs can extend the process further.

Tip: Expect the process to take at least 4–6 weeks under normal circumstances, and plan accordingly.

Choosing the Wrong Company Structure

Picking the wrong structure, such as setting up as an autónomo when an SL is more suitable, can limit growth or increase tax burdens later.

Tip: Take time to review the differences between structures before applying, especially liability and taxation.

Not Seeking Professional Legal and Tax Advice

Trying to do everything alone can lead to expensive mistakes, especially when dealing with cross-border requirements.

Tip: Speak with legal and tax professionals who specialize in helping foreigners start businesses in Spain. Their advice often saves both time and money.

Why Lexidy Can Help with Starting a Company in Spain

Starting a company in Spain as a foreigner can feel overwhelming. Lexidy makes the process straightforward with expert guidance at every step.

How Lexidy Supports You

- Company Structure Guidance: Help choosing between SL, SA, subsidiary, or branch.

- NIE/NIF Applications: Assistance securing the required identification numbers.

- Legal Documentation: Drafting bylaws, shareholder agreements, and incorporation paperwork.

- Notary & Registry Coordination: Handling filings with Spanish authorities, finding solutions to fast track administrative steps.

- Tax Setup: Registration for corporate tax, VAT, and payroll.

- Ongoing Support: Legal and accounting services after incorporation, assistance with onboarding employees and HR support.

More Than Just Incorporation

Lexidy doesn’t stop once your company is formed. The team continues to support your growth with compliance, tax, and legal advice so you can focus on building your business.

Frequently Asked Questions About Starting a Company in Spain

Do I need to be a resident to start a company in Spain?

No. You do not need to live in Spain to open a company, but you must obtain a NIE (for individuals) or NIF (for companies). Non-resident companies may also need to appoint a local legal representative.

Can I be the sole shareholder of a Spanish company?

Yes. A Limited Liability Company (SL) can be formed with just one shareholder, whether an individual or another company.

What are the ongoing tax obligations for a Spanish company?

Spanish companies must file annual corporate tax returns, quarterly VAT returns (if applicable), and keep proper accounting records. Employers also handle payroll tax and social security for employees. Freelancers (Autónomos) declare personal income tax quarterly and annually.

How much capital do I need to start an SL?

An SL requires a minimum share capital of €3,000, which must be deposited in a Spanish bank account before or after incorporation.

Can I start a business in Spain without knowing Spanish?

Yes, but it can be challenging. Many legal and administrative procedures are in Spanish. Having bilingual advisors or legal experts can make the process much smoother.

What is the difference between an SL and an Autónomo?

- SL (Sociedad Limitada): A company structure with limited liability, separating business and personal assets. Requires €3,000 share capital.

- Autónomo: A self-employed individual taxed as personal income, with no minimum capital but full personal liability.

Need Support with Starting a Company In Spain?

Starting a business in Spain opens the door to one of Europe’s most dynamic markets. With access to the EU, a skilled workforce, and a vibrant entrepreneurial ecosystem, the opportunities are significant.

At the same time, the process involves navigating Spanish legal and administrative requirements. From choosing the right structure to registering with the proper authorities, careful planning is essential.

Working with an experienced corporate lawyer can make the difference between a smooth launch and frustrating delays. With the right support, you can focus on building your business instead of worrying about paperwork.

Ready to start your journey? Fill out the form below and connect with an expert to make your business in Spain a reality.