Planning a move to Spain with a Non-Lucrative Visa? One of the most important steps in the process is meeting the income requirements. Since this visa is designed for retirees and financially independent individuals, Spain wants to see that you have the financial means to live comfortably without needing to work.

Whether your funds come from savings, pensions, rental properties, or dividends, having a clear understanding of the rules can make all the difference in getting approved.

If you’re a non-EU retiree, a remote income earner, or someone living off investments or savings, this blog is for you. Our team of legal experts will explore everything you need to know about the income requirements for the Spain Non-Lucrative Visa.

Table of Contents

- 2025 Spain Non-Lucrative Visa Income Requirements

- Types of Acceptable Income for the Spain Non-Lucrative Visa

- Documents to Prove Passive Income

- Spain Non-Lucrative Visa Requirements for Families

- Common Mistakes When Proving Passive Income

- What If You Don’t Meet the Income Requirements for Spain’s Non-Lucrative Visa?

- How Lexidy Can Help with Your Non-Lucrative Visa Application

- Frequently Asked Questions About The Spain Non-Lucrative Visa

- Ready to Apply for Spain’s Non-Lucrative Visa?

2025 Spain Non-Lucrative Visa Income Requirements

To qualify for the Spain Non-Lucrative Visa in 2025, applicants must prove they have sufficient passive income or savings to support themselves without working in Spain. The financial threshold is based on Spain’s IPREM (Indicador Público de Renta de Efectos Múltiples), which is updated annually.

| 1 applicant | 1 applicant + 1 dependent | 1 applicant + 2 dependents | 1 applicant + 3 dependents | 1 applicant + 4 dependents | |

|---|---|---|---|---|---|

| Required Income per Month | €2,400 p/m | €3,000 p/m | €3,600 p/m | €4,200 p/m | €4,800 p/m |

| Required Income per Year | €28,800 p/a | €36,000 p/a | €43,200 p/a | €50,400 p/a | €57,600 p/a |

Minimum Income for Single Applicants

For 2025, the required income is expected to be at least 4x of the IPREM. While the exact IPREM figure for 2025 will be confirmed by the Spanish government, in 2025, this figure works out at approximately €2,400 per month or €28,800 per year.

Additional Income for Spouses & Children

If you’re applying with a spouse or dependents, you need to show an additional 100% of the IPREM per dependent. This works out at roughly €600 per month (or €7,200 per year) per additional family member.

Here’s an estimate of income/savings requirements for 2025:

- Single applicant: ~€2,400/month (€28,800/year)

- Married couple: ~€3,000/month (€36,000/year)

- Family of four: ~€4,200/month (€50,400/year)

How the Amount Changes Yearly

Since the IPREM is adjusted annually to account for inflation and economic changes, the exact Non-Lucrative Visa income requirement may increase slightly each year. It’s crucial to check the updated IPREM figures before submitting your application to ensure you meet the minimum financial thresholds.

Types of Acceptable Income for the Spain Non-Lucrative Visa

To qualify for the Spain Non-Lucrative Visa, applicants must demonstrate a stable and passive source of income or have enough savings to support themselves without working. The most important and reliable way to show this is through savings. Consulates typically give more weight to savings and checking accounts as the primary proof of financial stability.

However, other forms of passive income are also accepted. This income must be reliable, consistent, and not derived from employment. Below we have compiled a list of the main sources of income that are accepted:

1. Pensions

For retirees, pension payments are one of the most commonly accepted sources of income. This can include:

- Government or state pensions

- Private or corporate pension plans

- Social Security benefits (if applicable)

To prove income from your pension, applicants typically need to provide official pension statements, bank deposits, and tax returns.

2. Rental Income

If you own property and receive rental income, it can count toward your financial requirements. However, as the key factor is proof of stable rental payments, short-term vacation rentals may be less reliable than long-term leases. It is recommended to also show savings in addition to the proof of payments for the leases.

To prove rental income, you should submit:

- Official lease agreements

- Rental payment records (bank statements)

- Tax declarations showing rental income

3. Dividends & Investment Income

Income derived from stocks, bonds, mutual funds, or other investments can be used as long as it shows regular and stable returns. Spain prefers passive investment income that does not require active management.

However, it’s important to note that while it is possible to present investment accounts, in general, Consulates ask for savings/checking accounts. So, preferably, the investments should be shown as extra documents and not as the main proof of economic means.

Required documentation may include:

- Dividend payment statements

- Investment portfolio summaries

- Tax filings proving passive investment income

4. Passive Business Income (Not Active Work)

If you receive passive income from a business (such as earnings from a company you own but do not actively manage), this can also be accepted. You must prove that the business does not require your involvement on a day-to-day basis.

Common passive business income sources include:

- Profits from a company where you are a shareholder

- Royalties from books, patents, or intellectual property

- Income from automated or outsourced online businesses

For passive business income, you may need to provide:

- Business tax returns

- Proof of dividends or shareholder distributions

- Legal documents showing you are not actively working

This is the less recommended way to prove the economic means since the Consulate might ask for extra documents to ensure you will not work, which can complicate the process. Here, as well as with the above, savings/checking accounts are the best way to prove the economic means.

Spain strictly enforces the non-working condition of the Non-Lucrative Visa, so any income that requires active employment or freelance work may not be accepted. Want to know if you qualify for the Spain Non-Lucrative Visa? Our Spain Non-Lucrative Visa service page has the full eligibility checklist plus expert tips.

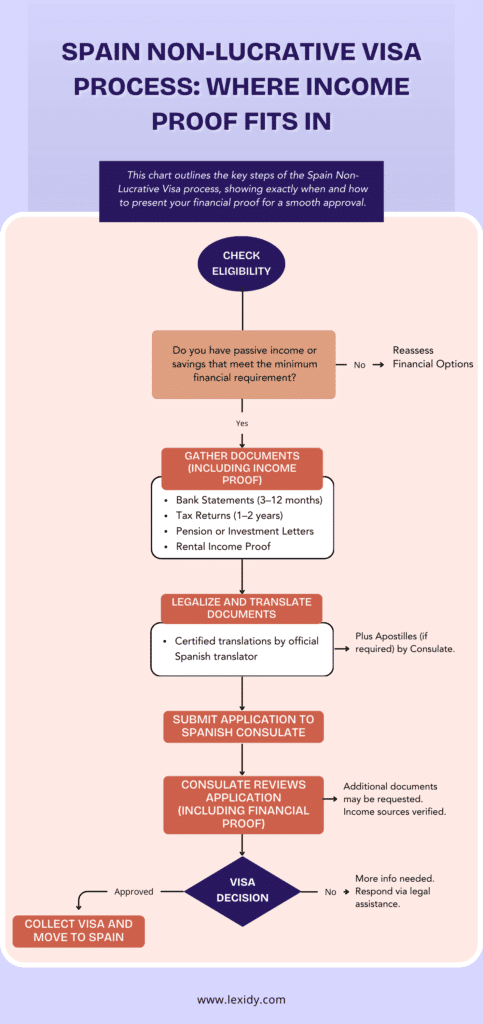

Documents to Prove Passive Income

For a successful application for the Spain Non-Lucrative Visa, the income requirements state that you must provide clear and verifiable proof of your financial stability. Spanish authorities require documents that demonstrate consistent, passive income over time. Below are the key financial documents you’ll need to include in your application.

| Document | What it Proves | What’s Required | Translation/Apostille |

| Bank Statements (3–12 months) | Proof of savings and financial stability | – From a reputable bank – Stable savings balance – Signed bank letter | ✅ Official translation ⛔ Apostille often not required |

| Tax Returns (Last 1-3 years) | Mainly to verify employment status | – Full copies of returns – If retired: pension withdrawal info | ✅ Translation required ✅ Apostille often required |

| Pension Letters | Verifies passive income for retirees | – Government or private pension award letters | ✅ Translation required ✅ Apostille often required |

| Investment Income Proof | Confirms regular dividends or capital income | – Account summaries – Dividend statements – Shareholder distributions | ✅ Translation required ⛔ Apostille not always needed |

| Rental Income Documentation | Validates consistent rental payments | – Lease agreements – Rental payment records – Tax declarations | ✅ Translation required ⛔ Apostille varies |

| Passive Business Income Documentation | Confirms non-active involvement in business | – Shareholder agreements – Dividend payout statements – Business tax return | ✅ Translation required ✅ Apostille if tax-related |

1. Bank Statements (Last 3–12 Months)

You must provide official bank statements showing enough savings to spend one year in Spain without the need to work. Typically, consulates require anywhere from 3 to 12 months of bank statements.

Requirements:

- Statements from a reputable bank

- Must clearly show stable savings

- Sufficient balance to meet financial thresholds

- Certified by your bank through a signed verification letter

2. Tax Returns (Last 1–3 Years)

Copies of the last 1–3 years of your tax returns are generally required. This is to verify your current employment status. This way they can request a resignation letter or an affidavit where you commit to not work as a freelancer from Spain.

If you are applying as a retiree, your tax documents should indicate pension withdrawals.

3. Investment & Pension Letters

If you receive passive income from investments, dividends, or pensions, official documentation is needed.

Documents to include:

- Pension award letters (from government or private institutions)

- Investment account summaries showing dividends or withdrawals

- Proof of rental income (lease agreements + payment records)

If you receive business income that qualifies as passive, provide shareholder agreements or dividend statements.

4. Translations & Apostilles

Since your documents may be issued outside of Spain, they must be translated by an official Spanish translator.

Not all consulates require apostilles for bank statements, but they often do for tax returns and pension letters. Always check with your local Spanish consulate.

Gathering the right financial documentation is crucial for proving long-term financial stability. Ensuring your documents are clear, well-organized, and properly translated will help avoid delays in the visa process.

Spain Non-Lucrative Visa Requirements for Families

If you’re applying for the Spain Non-Lucrative Visa with your spouse and/or children, you must meet higher income thresholds. The Spanish government wants to ensure that all family members can be financially supported without working in Spain.

1. Extra Income Needed for Spouse & Children

As mentioned previously, the financial requirement is calculated using IPREM. For each additional family member, you must increase your income proof accordingly.

Estimated 2025 Requirements:

- Single Applicant: €2,400 per month (€28,800 per year)

- Accompanying Family Members: Additional €600 per month (€7,200 per year)

Example: A couple with two children would need at least:

€28,800 (Main applicant) + €7,200 x3 = €50.400 per year of passive income or savings.

2. Can Spouses Combine Income?

In most cases, the answer is yes, spouses can combine their passive income to meet the total requirement. However, the main applicant must still prove they have sufficient financial means in their own name.

Acceptable Income Sources for Spouses:

- Pension payments

- Savings

- Rental income

- Dividends & investment income

- Passive business income

Some consulates require that the main applicant meets the base income requirement alone, and the spouse’s income is only considered for dependents. Always check with your specific Spanish consulate.

3. How to Strengthen a Family Application

- Provide joint bank accounts (if applicable)

- Show steady passive income from both spouses

- Submit a clear family financial plan to demonstrate stability

Applying as a family requires careful financial planning to meet Spain’s increasing income thresholds. Next, we’ll cover common financial mistakes that lead to rejection—and how to avoid them.

Common Mistakes When Proving Passive Income

Even financially eligible applicants can face rejection if their income proof does not meet Spain’s strict requirements. Here are some common mistakes to avoid:

1. Not Providing Enough Months of Bank Statements

Failing to provide sufficient history can raise concerns about financial stability. Typically you’re required to submit 3/6 months of bank statements, but be prepared to be asked for up to 12 months.

2. Income in the Wrong Currency

If your income is in a currency other than euros, you must clearly demonstrate its euro equivalent. Providing exchange rate conversions from a reputable source (such as the European Central Bank) can help avoid confusion.

3. Income That Is Not Easily Traceable

Spain requires verifiable, stable passive income. If your income comes from multiple sources, make sure all payments are well-documented with clear transactions. Any cash deposits without explanation may be flagged.

Avoiding these mistakes ensures a smoother application process and reduces the risk of delays or rejection.

What If You Don’t Meet the Income Requirements for Spain’s Non-Lucrative Visa?

Not everyone immediately meets the minimum income requirements for the Spain Non-Lucrative Visa, but there are ways to strengthen your application if your passive income falls short.

Can Savings Count?

Yes, as we mentioned above, the Consulates take into account savings first before passive income. As a general rule of thumb, having at least 12 times the minimum annual requirement in liquid savings is your best chance at acquiring the Non-Lucrative Visa in Spain.

Other Assets You Can Show

Besides savings, other financial assets can also support your application. This includes:

- Investment portfolios (stocks, bonds, mutual funds)

- Real estate holdings (proof of property ownership and rental income)

- Trust funds or long-term financial investments

These assets should be well-documented and easily convertible to cash if needed.

Do you want to know more about Spain before applying for the Non-Lucrative Visa? Our recent blog post features 10 Interesting Facts About Spain that anybody moving here should know!

How Lexidy Can Help with Your Non-Lucrative Visa Application

Securing Spain’s Non-Lucrative Visa hinges on getting the financial proof exactly right. Even a small mistake—like a missing stamp or unclear bank record—can delay or derail your plans. That’s where Lexidy’s legal experts step in to make the process seamless and stress-free.

✅ Pre-Check Your Financial Documents

Lexidy’s team carefully reviews your savings, pension statements, and income records before you apply. This early review ensures everything meets Spain’s income thresholds and avoids costly last-minute surprises.

✅ Ensure Format & Translations Are Correct

Some Consulates may require certified translations and apostilles. The expert legal team at Lexidy ensures your bank statements, tax filings, and investment records are presented exactly how Spanish authorities expect.

✅ Consulate Coordination Made Easy

If additional documents are requested, Lexidy helps you provide the necessary proof quickly and effectively. This helps you stay on track and dramatically improves your chances of fast approval.

With Lexidy, there’s no second-guessing or chasing documents—just expert support and clear guidance at every step. Ready to make your move stress-free? Fill out the form below and let Lexidy help you secure your Non-Lucrative Visa.

Frequently Asked Questions About The Spain Non-Lucrative Visa

How much income do I need for Spain’s Non-Lucrative Visa?

For 2025, a single applicant needs at least 400% of Spain’s IPREM, with additional income required for dependents. This amount is updated yearly.

Can rental income count towards the Spain Non-Lucrative Visa Requirements?

Yes, rental income is accepted as long as it is well-documented with lease agreements and bank statements showing regular deposits.

Does proof of passive income need to be in euros?

Not necessarily, but the equivalent of foreign currency amounts must correspond to the required amount in euros.

What if my income changes month to month?

Consistency is key. You may need to show a stable average over at least 6-12 months to prove long-term financial sufficiency or have stable savings.

Ready to Apply for Spain’s Non-Lucrative Visa?

Proving sufficient and stable income is the most important part of a successful Spain Non-Lucrative Visa application. Ensuring your financial documents meet the consulate’s requirements—correct amounts, proper formatting, and certified translations—can make all the difference in avoiding delays or rejections.

If you need expert guidance, Lexidy’s immigration team can review your documents, confirm they meet Spain’s strict standards, and help strengthen your application.

Whether you’re ready to move forward or just exploring your options, you’ll find everything you need on our Spain Non-Lucrative Visa service page — or simply fill out the form below to speak with our team.