Setting up a business in France is a smart move for entrepreneurs who think globally and act strategically. France is more than wine and weekends in Paris. It’s one of the EU’s strongest economies, with real opportunities for international founders. From access to a massive single market to generous government support for innovation, France has quietly become a powerful springboard for business growth.

That said, the process can be complex. For non-EU citizens in particular, setting up a business in France involves more than filling out forms. It requires navigating administrative procedures, preparing legal documents in French, and complying with tax and regulatory rules that vary by sector.

This blog walks through each step of the process. From confirming your eligibility to choosing the right legal structure, business registration, tax obligations, and social security requirements.

Table of Contents

- 1. Legal Eligibility to Start a Business in France

- 2. Required Legal Documents for Foreign Entrepreneurs

- 3. Choosing the Right Business Structure in France

- 4. Drafting the Articles of Association (Statuts)

- 5. Opening a French Business Bank Account

- 6. Publishing a Legal Notice ( Avis de Constitution )

- 7. Registering Your Company with French Authorities

- 8. Registering for Tax and Social Security

- 9. Licensing and Sector-Specific Permits (If Applicable)

- 10. Onboarding Compliance and Legal Obligations

- Legal Checklist for Setting up a Business in France

- Should You Hire a Lawyer to Register a Business in France?

- Need Assistance with Setting up a Business in France?

1. Legal Eligibility to Start a Business in France

Before you can register a company in France, you must ensure that your residence status legally allows you to carry out commercial activity. This is particularly important for non-EU entrepreneurs, as your right to live in France does not automatically mean you have the right to run a business.

EU/EEA and Swiss Citizens

If you’re a citizen of an EU or EEA country (or Switzerland), you do not need a visa or residence permit to start and manage a business in France. You will need to follow all legal steps (like any other entrepreneur) for company formation, but no immigration-related approvals are required.

Non-EU Citizens: Visa Requirements

If you’re from outside the EU, you’ll need a valid residence permit that explicitly authorizes business activity. There are a couple of common visa types for entrepreneurs, which include:

- Talent Passport (Business Creator): For investors or entrepreneurs planning to set up or buy a business in France with a solid business plan and sufficient financial backing.

- Entrepreneur/Independent Professional Visa: For self-employed professionals or founders creating a company in France. Requires a viable business plan and proof of resources.

Whichever visa path you pursue, it must allow you to form and operate a company in France. You cannot register a business on a tourist visa or other restricted-status permits.

2. Required Legal Documents for Foreign Entrepreneurs

To legally register and operate a business in France as a foreign entrepreneur, you’ll need to gather both personal identification documents and business-related paperwork. Having the correct documents is essential to avoid delays during company formation, on top of ensuring they’re properly translated and certified.

Personal Documents

As a foreign founder, French authorities require you to provide:

- Valid Passport: A clear, up-to-date copy of your passport showing your identity and nationality.

- Proof of Address: This can be in France or abroad, depending on your residence status. A utility bill, lease agreement, or official correspondence may be acceptable.

- Criminal Record Certificate (Extrait de Casier Judiciaire): Most company registrations require a clean criminal record from your home country or countries where you have recently lived.

- Certified Translations (If Required): Any documents not in French must be translated by a certified translator (traducteur assermenté). This includes diplomas, criminal records, and proof of address.

Business Documents

Alongside your personal documents, you’ll also need to prepare or provide:

- Business Plan or Activity Description: Especially if you’re applying for a visa like the Talent Passport, you must clearly outline your proposed business activities, objectives, and economic viability.

- Proof of Professional Qualifications: For regulated professions (e.g., legal, medical, architectural), official proof of certification or experience may be required to launch your business.

- Visa or Residence Permit (If Already Obtained): If you’ve already secured the right to live and work in France, you’ll need to show a copy of your current visa or residence card confirming your eligibility to start a business.

All documentation must be up-to-date and consistent across applications. Any mismatch in details can result in delays or rejection.

Thinking about setting up a business in France? Learn how our corporate lawyers make the process smooth and compliant.

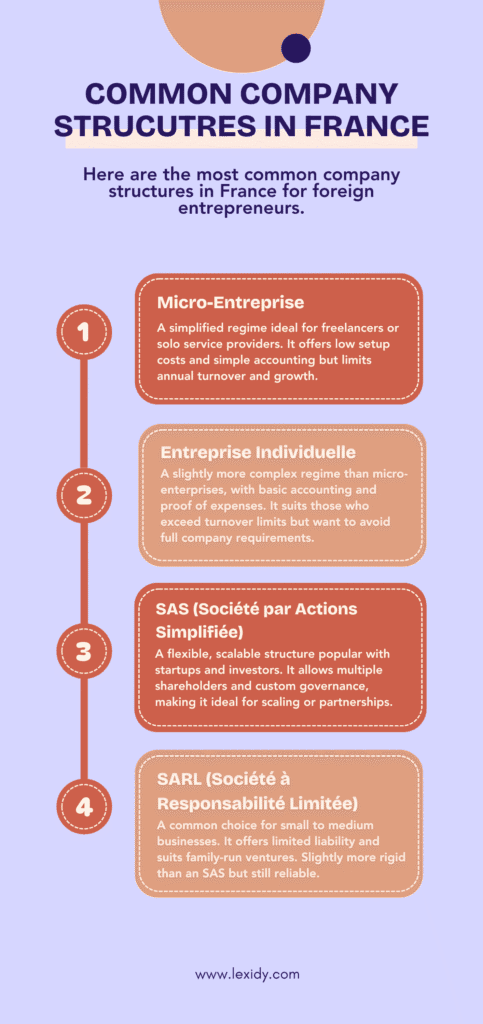

3. Choosing the Right Business Structure in France

Selecting the correct legal structure is one of the most important decisions you’ll make when setting up a business in France. It affects everything from taxation and liability to how you raise capital or bring in partners.

Common Legal Structures for Setting up a Business in France

Here are the main business structures in France suitable for foreign founders:

- Micro-entreprise (Auto-entrepreneur): A simplified regime for freelancers or small service providers. It’s easy to set up with reduced reporting, but it comes with strict income caps and no limited liability.

- Entreprise Individuelle (EI): A straightforward option for solo entrepreneurs. It offers minimal setup and admin, but doesn’t separate personal and business liability.

- SAS (Société par Actions Simplifiée): A flexible joint-stock company popular with startups and international founders. It allows multiple shareholders, simplified governance, and easier fundraising.

SARL (Société à Responsabilité Limitée): Similar to a limited liability company (LLC), ideal for small to medium businesses. It’s more rigid than an SAS in terms of governance but offers solid protections.

Key Comparison Points

| Legal Form | Liability | Taxation | Management Structure | Ideal For |

| EI | Unlimited | Income Tax (personal) | Sole operator | Solo entrepreneurs with simple needs |

| Micro-entreprise | Unlimited | Flat-rate income tax | Solo operator | Freelancers, small-scale services |

| SAS | Limited | Corporate Tax or Income Tax (option) | Flexible (customizable) | Startups, scalable businesses |

| SARL | Limited | Corporate Tax | Prescribed by law (less flexible) | Small to medium enterprises |

Micro-entrepreneurs or Entrepreneurs Individuels are personally liable for debts, meaning this option is not suitable for riskier ventures or product-based businesses.

When to Seek Legal Advice for Setting up a Business in France

Choosing the wrong structure can result in:

- Tax inefficiencies.

- Legal exposure.

- Regulatory compliance issues.

If you’re unsure which entity best suits your business model, consulting a lawyer early on is essential. Legal advisors can help you:

- Evaluate liability and tax exposure.

- Draft custom statutes.

- Ensure alignment with your visa type and business plan.

Not sure which business structure is right for you? Dive deeper in our article on the Types of Business in France for Foreign Entrepreneurs.

4. Drafting the Articles of Association (Statuts)

The Statuts (Articles of Association) are the foundational legal document of your French company. This is where you define how your business will operate, from its ownership structure to decision-making processes. It’s a mandatory step for all formal company types (SAS, SARL, EURL, etc.) and must be drafted in French.

What Must Be Included in the Statuts

You are required by French law to include key legal and operational details, such as:

- Company Identity: Business name, legal form, address (domicile), and purpose (object).

- Share Capital: Total capital, how much is contributed by each shareholder, and in what form (cash or assets).

- Governance Structure: The roles of directors or managers, who they are, how they are appointed, and their powers.

- Decision-Making Rules: How meetings are held, voting rights, and procedures for key decisions.

- Shareholder Rights and Obligations: Profit-sharing, transfer rules, and dispute mechanisms.

Optional Clauses for Flexibility

In more flexible structures like the SAS, the law allows you to include custom clauses, such as:

- Pre-emption rights for existing shareholders.

- Deadlock resolution mechanisms.

This is particularly useful for startups with investors or companies with multiple foreign partners.

Why Foreigners Often Get Rejected

It’s common for first-time founders, especially those unfamiliar with French legal drafting, to have their Statuts rejected by the commercial court (greffe) for any of the following reasons:

- Missing mandatory clauses.

- Language or formatting issues (must be in French).

- Legal inconsistencies or unclear governance.

- Use of non-standard templates that don’t align with the chosen structure.

Because your Statuts govern your company’s legality and internal operations, drafting them correctly from the beginning is critical.

Want to avoid costly mistakes? Get legal clarity on setting up a business in France.

5. Opening a French Business Bank Account

Opening a dedicated business bank account is a mandatory step when setting up a business in France, especially if you’re forming an SAS / SASU, SARL, or EURL. It’s where you must deposit your initial share capital, and it’s a prerequisite for registering your company.

Why It’s Required

Before you attempt to officially register your company, French authorities require proof that your share capital has been deposited. This proof comes in the form of an Attestation de dépôt de fonds, issued by your bank after the deposit is made.

Without this document, the registration process cannot move forward.

What You’ll Need to Open the Account

French banks typically require:

- Drafted Articles of Association (if applicable).

- A valid passport or ID for all shareholders.

- Proof of address (inside or outside France).

- A business plan or description of the company’s activity.

- Visa or residence permit (for non-EU residents).

- Sometimes, a tax identification number (TIN) from your home country.

You must also appoint a company representative (gérant or président) who will be authorized to open and manage the account.

Important Notes for Foreign Entrepreneurs

- Remote account opening is difficult. Most traditional French banks require in-person appointments.

- Some banks may decline foreign founders due to risk or documentation issues.

- Specialized legal partners like Lexidy can streamline this process by working with banks familiar with international founders.

Once the capital is deposited, your bank will issue the Attestation de dépôt de fonds, which you’ll include in your registration file.

6. Publishing a Legal Notice (Avis de Constitution)

Before your company can be officially registered in France, you must publish a legal notice (Avis de Constitution) announcing its formation. This requirement ensures transparency and creates a public record of your business’s creation.

Why It’s Required

The publication of a legal notice is necessary to formally inform the public, creditors, and government bodies of the existence of your new company. It is a mandatory part of the registration process. Failure to comply can lead to rejection by the Commercial Court Registry (Greffe).

Where to Publish

The notice must be published in an officially recognized Journal d’Annonces Légales (JAL) in the same department (département) where your business is established.

Each department in France has a list of approved publications. You can find one via the official journal directory or ask your legal advisor for recommendations.

What the Notice Must Include

The legal notice must contain key details about your business:

- Company name and legal form (e.g., SAS, SARL).

- Registered address (domicile).

- Company purpose (business activity).

- Share capital.

- Names and roles of directors or legal representatives.

- Duration of the company (usually 99 years).

- Information about the Articles of Association.

- Date of signature of the Statuts.

After publication, the journal will issue a certificate of publication, which must be included in your company registration file.

7. Registering Your Company with French Authorities

Now that all of your documents are ready and your legal notice has been published, it’s time to register your business with the French authorities. This formal registration process transforms your project into a legally recognized company.

Registration on the website of the business formalities office (Guichet Unique INPI):

Once the application has been made, the company is automatically entered in the national business register (RNE) and the trade and companies register (RCS).

To complete your application online, you’ll need to submit a comprehensive file, which typically includes:

- Articles of Association (Statuts).

- Proof of share capital deposit (attestation from the bank).

- Proof of company address (rental agreement, domiciliation contract).

- Valid passport(s) and ID of directors or legal representatives.

- Certificate of publication of the legal notice.

- Declaration of beneficial ownership.

- Statement of no criminal convictions and parentage.

- Visa or residence permit (if applicable).

Your legal advisor can help ensure that all documents are properly prepared and translated if needed.

Outcome of Registration

Once your application is validated by the authorities, you will receive:

- Kbis Extract: The official company registration certificate.

- SIRET Number: Your unique business identification number.

- VAT ID: For tax reporting and intra-EU transactions.

- APE Code: Classifying your business activity.

These credentials make your company legally operational in France.

Processing Time

Registration typically takes 1 week to 1 month. Delays often happen when documentation is incomplete or improperly filed, a common issue for foreign entrepreneurs unfamiliar with the system.

8. Registering for Tax and Social Security

Once your business is officially registered, you’ll need to complete several administrative steps to stay compliant with French tax and social security laws. These obligations begin from the moment your company is incorporated (even if you haven’t started trading yet).

Corporate Tax and VAT Registration

Your company will be automatically registered for corporate income tax (Impôt sur les Sociétés) during the incorporation process. Most companies are subject to a standard corporate tax rate of 25%, but there are reduced rates that may apply to small businesses under specific thresholds.

Additionally, your company is automatically registered for Value Added Tax (TVA or VAT) if your business exceeds France’s annual VAT threshold. This is currently €37,500 for services, €93,500 for goods, but make sure you double-check these numbers once you have registered your business. Once registered, you must:

- File periodic VAT returns.

- Charge VAT on invoices where applicable.

- Keep accurate sales and purchase records.

Social Security Contributions

All French businesses must register for social security contributions via:

- URSSAF: For general social security registration, especially for liberal professions and company directors.

- Special Pension Funds (for retirement and pension contributions) for certain professions (lawyers, architects, farmers, etc.).

If you pay yourself as a director or hire staff, your business becomes a social contributor. This means that the business must file monthly or quarterly declarations. These include:

- Health insurance.

- Family benefits.

- Retirement and pension contributions.

- Unemployment insurance (for employees only).

Directors of SAS companies usually contribute as salaried workers; SARL directors may contribute under a different regime. Your structure influences how you are classified for Social Security.

Employer Obligations When Hiring Staff

If your business hires employees, additional requirements apply:

- Register with the labor authorities (DPAE declaration before hiring).

- Set up payroll and employment contracts.

- Deduct and remit employee contributions alongside employer charges.

- Comply with French labor law and collective agreements.

This process is detail-heavy, especially for non-French speakers. Any errors during the hiring process can result in fines or back payments.

Bookkeeping and Accounting Setup

Accurate bookkeeping is not just recommended, it’s legally required. Upon registration, businesses must:

- Open accounting books.

- Retain supporting documents for income, expenses, and tax.

- File annual accounts (except micro-enterprises).

- Work with a certified accountant if possible.

Setting up a strong accounting and payroll system from the start helps avoid compliance issues and keeps you ready for tax audits. We recommend that you consult a chartered accountant to prepare your accounts.

9. Licensing and Sector-Specific Permits (If Applicable)

While many types of businesses in France can operate without special authorization, others (especially those affecting public health, safety, or regulated professions) require additional licenses or sector-specific permits before legally opening their doors.

Regulated Activities in France

If your company operates in any of the following sectors, you will likely need prior approval or professional certification:

- Food & Beverage: Businesses in hospitality or food preparation (e.g., restaurants, bakeries, catering) must obtain hygiene and safety certifications and, in some cases, alcohol sale licenses (permis d’exploitation).

- Construction & Trades: Builders, electricians, and plumbers may need to show professional qualifications (diplomas or experience) and register with the Répertoire des Métiers (RM).

- Transport & Logistics: Freight, delivery, and passenger transport businesses must register with the relevant transport authority and obtain an EU Community License.

- Medical & Health Services: Healthcare professionals (doctors, therapists, pharmacists) must hold recognized qualifications and register with the appropriate professional board (e.g., Ordre des Médecins).

- Education, Childcare & Security: These sectors are strictly regulated and often require background checks, specific qualifications, and facility inspections.

Where to Verify Requirements

If you’re unsure whether your business activity is regulated, the best course of action is to consult with:

- Your local Chamber of Commerce (CCI) for commercial businesses.

- The Chamber of Trades and Crafts (Chambre des Métiers) for artisan and manual professions.

- Sector-specific authorities or regulators, such as the Agence Régionale de Santé (for health) or DREAL (for transport and environment-related activities).

Many licensing procedures require certified translations of foreign qualifications, proof of experience, and in some cases, equivalency recognition by French authorities.

10. Onboarding Compliance and Legal Obligations

Starting your business in France is only the first step. Maintaining legal compliance is an ongoing responsibility. Foreign founders should be especially aware of French accounting, corporate, and tax rules to avoid fines or penalties.

Annual Filings and Financial Reports

French companies must comply with strict accounting and financial reporting standards:

- Annual accounts (comptes annuels) must be prepared and filed with the Commercial Court registry.

- Depending on your company’s size and structure, you may need to appoint a statutory auditor (commissaire aux comptes).

- Financial statements must follow French GAAP standards and be filed in French.

Declaration of Beneficial Ownership

Under French law, companies are required to file a UBO declaration (bénéficiaire effectif) identifying the individuals who ultimately own or control the business. This is typically submitted at the time of registration and updated when ownership changes.

Holding Annual General Meetings

If you’ve formed a SAS, SARL, or SA, you may be required to hold an annual general meeting (AGM) to approve the accounts and discuss key governance matters. Meeting requirements varies depending on your company’s legal structure.

The Role of an Expert-Comptable (Chartered Accountant)

A French chartered accountant (expert-comptable) is strongly recommended and especially for foreign-owned companies, as they’re an essential tool to keep your operations in order. An expert-comptable helps with:

- Bookkeeping and payroll.

- Tax compliance and filings.

- Preparing annual accounts.

Their guidance ensures that your company stays fully compliant with French regulations, giving you peace of mind and freeing up time to focus on business growth.

Lexidy partners with licensed French accountants to provide full-service compliance support for foreign founders.

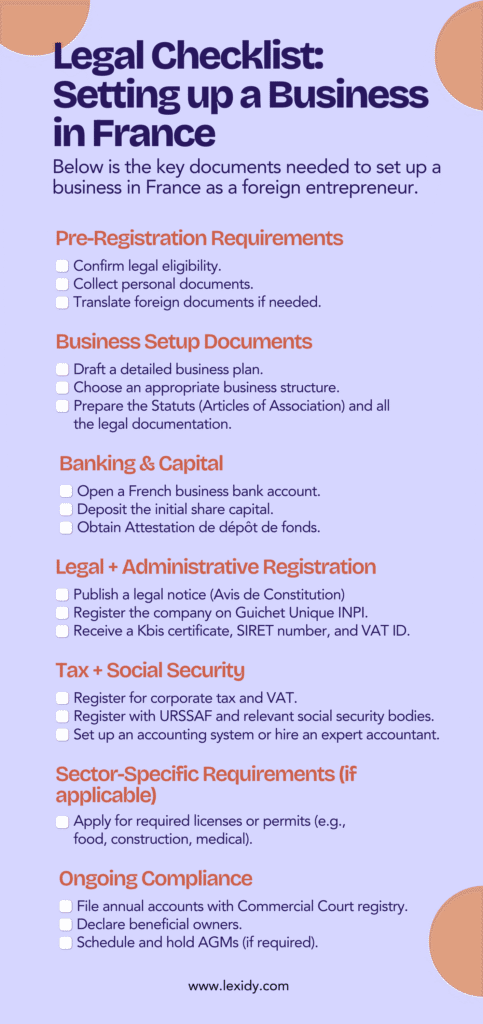

Legal Checklist for Setting up a Business in France

Starting a business as a foreigner in France involves several administrative and legal steps. Use this checklist to ensure you’re covering all the key requirements:

Pre-Registration Requirements

- Confirm legal eligibility (visa or residency status allowing commercial activity).

- Collect personal documents (passport, proof of address, criminal record certificate).

- Translate foreign documents if needed (certified translations).

Business Setup Documents

- Draft a detailed business plan or description of the activity.

- Choose the appropriate business structure (SAS, SARL, EURL, etc.).

- Prepare the Statuts (Articles of Association) and all the legal documentation.

Banking and Capital

- Open a French business bank account.

- Deposit the initial share capital.

- Obtain Attestation de dépôt de fonds.

Legal and Administrative Registration

- Publish a legal notice (Avis de Constitution) in an authorized journal.

- Register the company on the website Guichet Unique INPI.

- Receive a Kbis certificate, SIRET number, and VAT ID.

Tax and Social Security

- Register for corporate tax (Impôt sur les Sociétés) and VAT (automatic).

- Register with URSSAF and the relevant social security bodies.

- Set up an accounting system or hire an expert accountant.

Sector-Specific Requirements (If Applicable)

- Apply for required licenses or permits (e.g., food, construction, medical).

Ongoing Compliance

- File annual accounts with the Commercial Court registry.

- Declare beneficial owners.

- Schedule and hold AGMs (if required).

Too complex to manage alone? Let Lexidy’s multilingual legal team simplify it for you. Book a free consultation with our French legal team to start your business in France with full legal confidence.

Should You Hire a Lawyer to Register a Business in France?

While it’s legally possible to register a company in France on your own, going the DIY route is often risky. This is especially the case for non-EU citizens unfamiliar with the country’s legal system, language, and administrative culture.

When DIY Business Registration Isn’t Safe

Foreign entrepreneurs frequently run into challenges such as:

- Submitting incomplete or incorrectly filled forms.

- Misunderstanding visa or residence permit implications.

- Failing to meet specific publication, banking, or tax registration requirements.

- Choosing the wrong legal structure for their business goals.

Even small errors can lead to registration delays, rejections, or tax consequences down the line.

Why Foreign Founders Work With Lexidy

Lexidy helps entrepreneurs skip the bureaucratic headaches and start their business the right way. As a law firm focused on foreign clients in France, we provide:

- Legal clarity around eligibility and structure.

- End-to-end support with document drafting, translations, filings, and banking setup.

- Fast-track registration through expert handling of French administrative protocols.

- Multilingual guidance for smooth communication.

Whether you’re launching a tech startup, consultancy, or boutique brand, our corporate lawyers in France ensure your business is compliant from day one.

Need Assistance with Setting up a Business in France?

Setting up a business in France as a foreigner is entirely possible, but it requires a clear understanding of legal procedures, visa requirements, and registration steps. From choosing the right structure to filing the correct paperwork and complying with ongoing obligations, every phase matters.

Whether you’re launching a startup, expanding into the EU, or relocating your professional life to France, working with legal experts can save time, reduce risk, and help you start strong.

Fill out the form below to schedule a free consultation with our corporate lawyers and take the first step toward registering your French company.