Moving to Portugal from the UK remains a popular choice for many Brits. A warm climate, strong safety record, relaxed pace of life, and long-standing ties between Portugal and the UK continue to attract people at every stage of life, from retirees to remote professionals and families.

However, the legal reality of moving to Portugal from the UK has changed. Since 1 January 2021, UK nationals are treated as non-EU citizens, meaning freedom of movement no longer applies. It is no longer possible to arrive in Portugal and complete residency formalities locally without prior approval.

Any UK citizen planning to stay in Portugal for more than 90 days must apply for a long-stay residency visa in advance through the Portuguese Consulate in the UK. Only once this visa is granted can the residency process be completed in Portugal with AIMA.

This guide explains what moving to Portugal from the UK looks like in 2026. It covers the most suitable visa options for UK citizens, including the D7 Visa, the Digital Nomad Visa, and entrepreneur routes, and provides clear, practical guidance on how to navigate the post-Brexit legal requirements.

Table of Contents

Top Visa Routes for UK Citizens Moving to Portugal

Below is a simple comparison table outlining the three main residency visas available to UK citizens moving to Portugal after Brexit. These are the most common and accessible pathways depending on income type, work situation, and long-term plans.

| Visa Type | Target Applicant | Key Financial Requirement (2025 Estimate) | Best For |

| D7 Visa (Passive Income) | Retirees, individuals with passive income (pensions, rental income, dividends, investment income) | €11,040/year (equivalent to 12 months of the Portuguese minimum wage in passive income) | Retirees, financially independent individuals, and anyone with stable passive income |

| D8 Visa (Digital Nomad Visa) | Remote workers employed by a non-Portuguese company, or freelancers with international clients | €44,160/year (4× the minimum wage in earned remote income) | Remote professionals, digital workers, higher-income earners |

| D2 Visa (Entrepreneur Visa) | Entrepreneurs launching a new business or investing in an existing Portuguese business | Solid business plan + €15,000–€30,000 in available startup capital (varies by project) | Entrepreneurs, founders, and small business investors |

Curious to learn more? Discover all the Type D Visas in Portugal and their specific requirements.

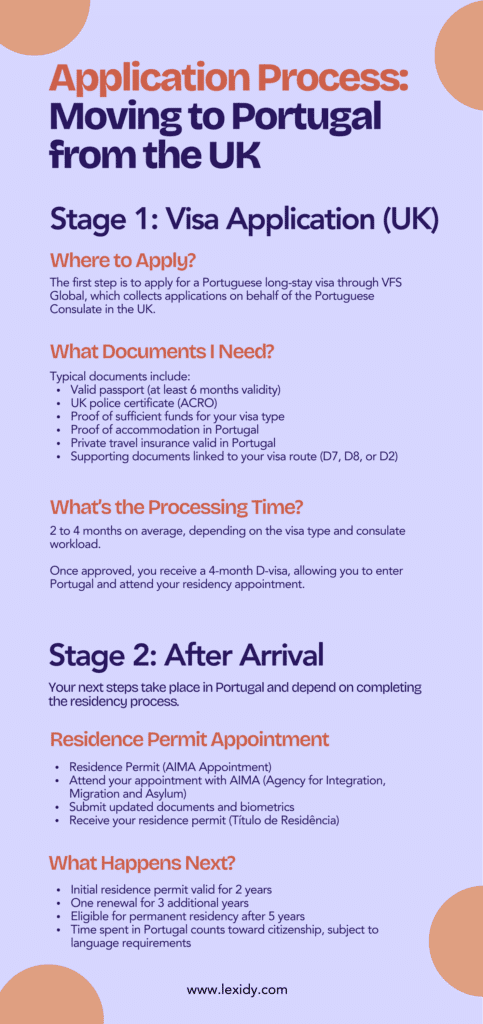

Moving to Portugal from the UK: Step-by-Step Residency Process

When moving to Portugal from the UK, the residency journey follows a strict two-stage process: first securing the long-stay visa in the UK, then completing the residency formalities in Portugal. This is mandatory for all Portugal visas for UK citizens and applies whether you are relocating to Portugal, retiring, or immigrating as a remote worker or entrepreneur.

Step 1: The Visa Application (in the UK)

Your application begins in the UK at VFS Global, which handles submissions on behalf of the Portuguese Consulate.

You must provide:

- A clean UK police certificate (ACRO)

- Proof of funds that meet the requirements of your chosen visa route

- Proof of accommodation in Portugal (rental contract, deed, or invitation letter)

- Private travel insurance valid in Portugal

- Passport valid for at least 6+ months beyond the visa period

Once approved, you receive a 4-month D-visa. This allows you to enter Portugal legally for the residency appointment.

Step 2: The Residence Permit (in Portugal)

After arrival, you will attend an appointment with AIMA (the Agency for Integration, Migration and Asylum, formerly SEF) to obtain your Título de Residência.

Key points:

- Initial validity: 2 years

- Renewal: 3-year extension

- Long-term status: Eligible for Permanent Residency after 5 years of continuous lawful residence

- Time in Portugal under these visas counts toward citizenship and permanent residency if language requirements are met

This two-step structure is identical whether you apply under the D7, D8 Digital Nomad, or D2 Entrepreneur Visa, and is the core legal pathway for any UK citizen moving to Portugal post-Brexit.

Key Financial and Logistical Considerations

Relocating to Portugal as a UK citizen in 2026 goes beyond securing the correct visa. Below are the key financial and logistical considerations to be aware of before making the move to Portugal.

Cost of Living Comparison: Portugal vs the UK

For most Brits, Portugal offers a noticeably more affordable lifestyle compared to the UK, especially in comparison to London or the South East.

- Groceries are typically ~20% cheaper

- Restaurant and café dining can be up to 40% cheaper than in the UK.

The difference in housing costs depends heavily on location. Rural areas, the Algarve (outside hotspots), and smaller cities offer excellent value. On the other hand, Lisbon and Porto have seen significant price growth in recent years.

As a result, rent or purchase prices in central areas can be comparable to UK regional cities but are still more affordable than major UK metropolitan centres. Day-to-day living costs remain lower overall, making Portugal attractive for retirees, remote workers, and families seeking a more relaxed and cost-efficient lifestyle.

Healthcare

Once classed as non-EU citizens, UK nationals no longer have automatic access to Portugal’s public healthcare system (SNS). As part of any long-stay visa application, private health insurance is mandatory, typically requiring coverage equivalent to the public system.

After securing residency and registering with local authorities, residents can access the SNS on the same basis as Portuguese citizens. The system offers quality care at low cost, but many expats continue to maintain a private policy for fast access to English-speaking specialists and reduced waiting times.

Driving Licence

UK driving licences remain valid in Portugal for 12 months after residency is granted. Beyond that point, residents must exchange their UK licence for a Portuguese driving licence through the IMT (the Portuguese transport authority). The exchange process can be delayed due to waiting times, so it’s best not to leave it until the final months of the validity window.

These steps can feel complex, especially when planning a move abroad. Guidance from experienced Portugal immigration lawyers can help you navigate each stage with clarity.

Moving to Portugal from the UK: Tax Obligations and the NHR Update

Understanding Portugal’s tax system is essential when planning long-term relocation from the UK. Once you meet Portuguese tax residency criteria, your worldwide income becomes taxable in Portugal.

Tax Residency

If you spend 183 days or more in Portugal within 12 months, or maintain a habitual residence there, you are considered a Portuguese tax resident. At that point, you will be taxed on your global income, including UK pensions, rental earnings, dividends, and salary.

The End of NHR for Newcomers

A critical update for anyone moving in 2025 is that the Non-Habitual Resident (NHR) regime, famous for its 10% flat tax on foreign pensions, has been phased out for new applicants as of 2024. This means new residents can no longer access NHR’s preferential tax rates or exemptions.

What This Means in Practice

Without NHR, most foreign income (including UK pensions) is taxed under Portugal’s standard progressive rates, reaching up to 48% for higher-income individuals. This represents a significant shift from the tax environment many Britons previously benefited from.

UK–Portugal Tax Treaty

Despite higher local tax rates, the UK-Portugal Double Taxation Agreement helps prevent the same income from being taxed twice. Taxes paid in one country can generally be credited against liabilities in the other. So while you must comply with Portuguese tax rules, you are not double-taxed on UK pensions, earnings, or investment income.

Need Support Moving to Portugal from the UK?

Moving to Portugal from the UK in 2026 is still possible, but it now requires proper planning and the right residency route. Since the end of EU free movement, the process involves more formal steps, yet Portugal remains a stable and appealing option for UK nationals looking to relocate.

The most important decision is choosing the correct visa from the start. Options such as the D7, the Digital Nomad Visa, the D2 entrepreneur route, or family-based residence each come with different income requirements, timelines, and long-term considerations. Selecting the right path early can help avoid delays and unnecessary complications later on.

If you want clarity on which option fits your situation, professional guidance can help you move forward with confidence. Fill out the form below to get personalized legal guidance on moving to Portugal from the UK.