Considering moving to Spain from the USA? You’ve come to the right place. This guide covers everything from visas to housing and healthcare, tailored for Americans like you, dreaming of a new life in this vibrant country. Whether you’re a retiree, entrepreneur, remote worker, or student, you’ll find practical, step-by-step advice to navigate the move smoothly.

Our trusted lawyers packed this guide with up-to-date, expert-backed information designed to simplify your transition, complete with tools like comparison tables and checklists to ensure you’re well-prepared for your adventure to Spain.

Keep reading to discover key insights that will help make your move to Spain from the USA in 2025 successful and exciting.

Table of Contents

- Choosing the Right Visa for Moving to Spain from USA

- How to Move to Spain From the US: A Step-by-Step Process

- Financial & Legal Essentials for Moving to Spain from the USA

- Tax Considerations for Moving to Spain as an American

- Renting vs. Buying in Spain: Costs, Benefits, and Process

- Best Cities in Spain for American Expats

- Avoiding Rental Scams: Red Flags & Common Mistakes

- Healthcare Comparison: Public vs. Private in Spain

- Cultural Adaptation & Integration in Spain

- Moving to Spain from the USA Timeline

- Ready to Move to Spain from the USA?

Choosing the Right Visa for Moving to Spain from USA

Choosing the correct visa is a critical first step in your relocation to Spain. Here’s an expanded comparison of visa options that include specific financial requirements and work eligibility:

| Visa Type | Best for | Requirements | Work Eligibility |

| Non-Lucrative Visa | Retirees, financially independent | Proof of stable passive income: Minimum of €2,400/month for the main applicant, plus €600/month per dependent family member. | No work allowed |

| Digital Nomad Visa | Remote workers, freelancers | Proof of stable foreign income: Minimum of €2,763/month for the main applicant, plus €1,036/month for the first family member and €345/month for each additional family member. | Work for non-Spanish companies |

| Student Visa | Students | Proof of enrollment, comprehensive health insurance, plus approximately €600/month for living expenses. | Limited work hours permitted (for superior studies) |

| Work Visa | Professionals with a Spanish job offer | Job offer from a Spanish employer demonstrating salary meets or exceeds minimum legal standards. | Full work rights in Spain |

| Entrepreneur Visa | Business founders, independent contractors and innovative entrepreneurs | Detailed business plan, proof of qualification or experience, having potential clients in Spain. Must demonstrate sufficient funds to start the business and to support themselves, this later case, at least €600/month. | Full work rights in Spain |

Non-Lucrative Visa (NLV)

Ideal for retirees or financially independent individuals who can prove they have sufficient funds to support themselves without working at all. Applicants must show a stable income from investments, pensions, or other non-work sources or have enough savings to reside in Spain for one year. This visa does not allow you to work and you will be asked to prove that you either receive a pension or have stopped working in your country.

Digital Nomad Visa

Designed for remote workers and freelancers who earn their income from companies outside of Spain. Applicants need to demonstrate a regular income and the ability to perform their work remotely for companies. This visa is particularly appealing due to its flexibility and the lifestyle it allows in Spain.

Student Visa

For individuals enrolled in full-time educational programs at Spanish institutions. This visa requires proof of enrollment, comprehensive health insurance in Spain and sufficient financial resources to cover living expenses throughout the duration of study. It allows limited working hours for certain types of studies, which can help supplement living costs.

Work Visa

Requires a formal job offer from a Spanish employer. The visa process typically involves the employer proving that the position could not be filled by a local candidate unless you are considered a highly qualified professional. This visa grants full work rights and is essential for those looking to relocate to Spain for professional reasons.

Entrepreneur Visa

Aimed at individuals planning to establish or run a business in Spain. This visa requires a detailed business plan, showing the viability and economic benefits of the proposed business.

Curious about how this works? Visit our Immigration Spain service page, where we break down our key services in Spain and explain how we can help.

How to Move to Spain From the US: A Step-by-Step Process

1. Determine the Right Visa Type:

Carefully assess your situation and objectives to choose the most appropriate visa. Consider factors such as your financial status, whether you plan to work, study, or invest, and your long-term goals in Spain.

2. Prepare Required Documents:

Gather all necessary documentation, which may include:

- Valid passport with at least 1 year remaining before expiration.

- Visa application form, completed and signed.

- Recent passport-sized photographs.

- Proof of financial means, such as bank statements or income verification.

- For work visas, a job offer from a Spanish employer.

- For student visas, an admission letter from a Spanish educational institution.

- For entrepreneur visas, a detailed business plan.

- Criminal record certificate from your country of residence.

- Medical certificate proving you are free from certain contagious diseases.

3. Submit Your Application:

- Applications are typically submitted at a Spanish consulate or embassy in your home country. Some consulates may allow or require appointments to be booked in advance.

- Ensure all forms are accurately completed and all required documents are included to avoid delays.

4. Attend an Interview (if required):

Some visa applications require a personal interview. During the interview, consular officers assess your application, intentions, and ties to your home country.

5. Track Your Application:

After submission, you can usually track the status of your application online. Processing times can vary widely based on the visa type, the volume of applications, and the specific consulate.

6. Receive Your Visa:

If approved, you will be notified to collect your visa. Some consulates may send the visa directly to you.

7. Arrive and Register in Spain:

Upon arrival, register with the local authorities, apply for a foreign identity card (TIE), and complete any other residency formalities.

Financial & Legal Essentials for Moving to Spain from the USA

Navigating financial and legal systems in a new country can be complex. Here’s a guide to help you manage these essentials as you prepare to move to Spain from the USA:

Cost of Living Breakdown: Madrid vs. Valencia vs. Rural Spain

Understanding the cost of living is essential when planning your move to Spain from the US. Here’s what you can expect in both urban and rural settings:

Madrid

As Spain’s capital, Madrid offers a vibrant lifestyle but comes with higher living costs. Average monthly living expenses (excluding rent) for a single person are about €900. Rent ranges from €900 for a one-bedroom apartment on the city outskirts to €1,500 in the city center.

Valencia

This coastal city provides a more affordable alternative to Madrid, with a rich cultural scene. Average monthly expenses without rent are around €700. Rent for a one-bedroom apartment ranges from €600 outside the city center to €900 within it.

Rural Spain

For a quieter life and lower costs, rural Spain offers great value. In popular rural towns such as Ronda in Andalusia, Cuenca in Castilla-La Mancha, and Trujillo in Extremadura, average living expenses can be as low as €600 per month, with rental costs ranging from €400 to €700.

These towns provide a peaceful setting combined with a rich historical ambiance, ideal for those looking to immerse themselves in authentic Spanish culture away from the urban rush.

Banking in Spain – How to Open a Bank Account

Opening a bank account in Spain is straightforward. You’ll need:

- Your NIE (Número de Identidad de Extranjero).

- Passport or national ID card.

- Proof of address (utility bill or rental agreement).

- Proof of employment or financial status (like a job contract or a pension statement).

Most banks offer services in English, and digital banking options are widely available.

Tax Considerations for Moving to Spain as an American

Understanding the tax implications is crucial when relocating to another country. Here are some key tax considerations for those planning to move to Spain from the USA:

Worldwide Taxation

- Residents: In Spain, tax residents are subject to worldwide income tax, meaning that all income earned, both domestically and abroad, is taxable in Spain. Tax residency is typically established by spending more than 183 days in Spain during the calendar year, but we have other aspects also to be considered Spanish tax resident (i.e. if the main center or vital and economic interest is located in Spain).

- Non-Residents: If you don’t meet the residency criteria, you are only taxed on income that is sourced in Spain. This includes earnings from Spanish employment, property rentals, empty properties located in Spain, or business operations within the country.

Beckham Law (Special Regime for Inbound Workers)

The Beckham Law allows certain expatriates to opt for a special tax regime for the first six years of residency. Under this law, an individual is taxed only on Spanish worldwide employment income and Spanish-sourced private income at a flat rate of 24% on earnings up to €600,000 (as of the current regulation). Income above this threshold is taxed at 47%. Savings tax rates runs from 19% to 30%.

This regime is particularly beneficial for high earners relocating to Spain to work for Spanish companies, and unfortunately, it does not include freelancers.

Curious if you qualify? Check out our Beckham Law service page here to learn more. Remote employees can also be eligible if certain requirements are met.

US-Spain Tax Treaty

The treaty between the United States and Spain is designed to prevent double taxation on income earned in both countries. Key provisions include:

- Relief through Foreign Tax Credits: U.S. citizens can claim a credit for taxes paid in Spain, which can reduce their U.S. tax liability on the same income.

- Exemptions and Reduced Rates: Certain types of income, such as dividends, interest, and royalties, may be taxed at a reduced rate or exempted under the treaty, depending on where the income is sourced and the recipient’s country of residency.

- Pension and Social Security Payments: Specific rules apply to pensions and social security benefits, which can be taxed differently under the treaty, often favoring taxation only in the country of residence (i.e. pension received from a previous public service).

Pro Tip: Consult WIth a Tax Lawyer for Expats

Given the complexities of tax laws and treaty provisions, consulting with an experienced tax advisor is highly recommended. We can help you navigate exemptions, avoid pitfalls, and optimize your unique tax situation. Contact us using the form below to learn more.

Renting vs. Buying in Spain: Costs, Benefits, and Process

| Aspect | Renting in Spain | Buying in Spain |

| Costs | – Monthly rent varies by city and location. – Security deposits are typically 1-2 months’ rent. | – Long-term investment and potential property value appreciation. – Freedom to modify or renovate as desired. – Potential rental income if not used as the primary residence. |

| Benefits | – Flexibility to move or change locations. – Less financial burden upfront. – No responsibility for maintenance or repairs. | – Find a property through websites or real estate agents. – Sign a lease agreement, typically for one year. – Registration of the contract is not mandatory, but can provide legal security. |

| Process | – Find a property through websites or real estate agents. – Sign a lease agreement, typically for one year. – Registration of the contract is not mandatory, but it can provide legal security. | – Identify property through agents or property portals. – Engage a lawyer for due diligence. – Sign a pre-agreement (contrato de arras), then finalize the sale at a notary. – Register the property in your name at the local property registry. |

Best Cities in Spain for American Expats

When moving to Spain as an American, finding the right city to live in can greatly enhance your expat experience. Here’s a closer look at some of the top cities:

Madrid

As the capital and largest city of Spain, Madrid is the heart of Spanish politics, culture, and nightlife. It offers a bustling metropolitan lifestyle with countless museums, theaters, and historic sites, such as the Prado Museum and the Royal Palace. The city is also known for its expansive parks like El Retiro. It’s ideal for professionals and families alike due to its diverse educational facilities and robust job market.

Barcelona

Famous for its artistic flair and architectural marvels by Antoni Gaudí, such as Sagrada Familia and Park Güell, Barcelona provides a vibrant coastal lifestyle. The city boasts a unique blend of modernist and Gothic architecture, bustling markets like La Boqueria, and lively beaches. It’s particularly appealing for creatives, students, and those in tech startups.

Valencia

Known for its innovation and recently gaining popularity among digital nomads, Valencia offers a slower pace of life compared to Madrid and Barcelona with a significantly lower cost of living. The city features stunning attractions like the City of Arts and Sciences, thriving food scenes, and expansive beaches. It’s perfect for those seeking a balance between urban living and seaside relaxation.

Málaga

Located on the southern coast of Spain in the Costa del Sol, Málaga is a hotspot for retirees and those looking for sunny weather year-round. The city offers a rich cultural history, being the birthplace of Picasso, and features numerous museums and historical sites. Málaga is also renowned for its golf courses, beachfront properties, and vibrant expat community, making it ideal for leisure and retirement.

Sevilla

This city in the heart of Andalusia is famed for its historical legacy, vibrant festivals like Feria de Abril, and architectural gems such as the Alcázar palace and the Sevilla Cathedral. Seville offers a deep dive into traditional Spanish culture with a slower pace of life and lower cost of living. Its warm climate and welcoming locals make it a charming choice for expats.

Avoiding Rental Scams: Red Flags & Common Mistakes

When moving to Spain from the USA, navigating the rental market can be daunting. Here are key insights to help you avoid rental scams and ensure a smooth housing experience in Spain:

Red Flags to Watch Out For

- Advance Payment Requests: Be cautious if you are asked to send a large deposit or several months’ rent in advance before signing a lease or seeing the property in person. While some deposit is normal, excessive upfront demands can be a scam.

- Too Good to Be True: If the rental price is significantly below market rate for a similar property in the area, it might be a scam. Always compare listings to get a sense of average prices.

- Lack of Documentation: A legitimate landlord or agent will provide proper rental contracts and receipts for any transactions. Be wary of those who avoid providing documentation or who offer only verbal agreements.

- Rush Tactics: Scammers often pressure potential renters to make quick decisions, claiming that other interested parties are ready to take the property. Take your time to research and think over any rental agreement.

- Unverifiable Identity or Ownership: Ensure the person you are dealing with is the actual owner or a legally authorized agent. Request to see identification and proof of ownership or management rights.

Common Mistakes to Avoid

- Failing to Research the Property: Always check the property physically or ensure there’s a reliable virtual tour. Use Google Maps to verify the property’s location and authenticity.

- Skipping Property Viewing: If possible, visit the property in person or ask someone you trust to do so on your behalf. This can help you avoid scams involving non-existent properties.

- Not Reading the Lease Agreement Thoroughly: Understand all terms and conditions before signing. If the lease is in Spanish and you are not fluent, get a translation or a bilingual expert to review it.

Ignoring Local Rental Laws: Familiarize yourself with tenant rights and rental laws in Spain. Knowing these can help you spot irregularities in your rental agreement or landlord demands. - Not Securing a Rental Receipt: Always ask for a receipt when making any payment. This serves as proof of the transaction and can be crucial if disputes arise.

Pro Tip: Use reputable rental websites and consider engaging with a local real estate agent. Websites like Idealista, Fotocasa, and Habitaclia are popular and generally reliable. Local agents can provide valuable assistance, ensuring that all legal requirements are met and helping to navigate the local market more effectively.

Healthcare Comparison: Public vs. Private in Spain

| Aspect | Public Healthcare | Private Healthcare |

| Cost | Covered by social security contributions. No cost at the point of service for most services. | Premiums range from €30 to €200 per month based on coverage level, age, and health. Copays may apply. |

| Wait Times | Longer wait times, especially for non-emergency procedures and specialist consultations. | Significantly reduced wait times for all services, including specialist appointments and surgeries. |

| Language Options | Primarily Spanish; limited English services except in major cities or tourist areas. | Widespread English-speaking doctors and medical staff, especially in providers catering to expats. |

Who Qualifies for Public Healthcare?

- Residents: If you are a resident in Spain and contribute to the Spanish social security system, you are entitled to access public healthcare. This includes employed or self-employed expats who make social security contributions.

- Non-Residents: Non-residents generally do not qualify for public healthcare unless they are registered as residents and contribute to social security.

- Special Cases: Certain visas, such as the Non-Lucrative Visa, do not automatically qualify for public healthcare since these visa holders are not allowed to work and, therefore, do not make social security contributions. These individuals need to have private health insurance.

Private Insurance Options: Costs and Best Providers for Expats

- Costs: Private health insurance costs can vary widely depending on the coverage level, age, and health status of the applicant. Basic plans may start as low as €30-€50 per month, with more comprehensive coverage costing €100 or more.

- Providers: Some of the best-known health insurance providers for expats in Spain include Sanitas, DKV, ASSSA, and Adeslas. These companies offer various plans tailored to expats, often including benefits like dental care, repatriation, and multilingual support.

Cultural Adaptation & Integration in Spain

Successfully integrating into the culture can enhance your expat experience when moving to Spain from the US. Here are streamlined tips for smoothly blending into the local lifestyle:

Language Spanish

Mastery of Spanish is crucial for your daily interactions and understanding of cultural nuances. Even basic language skills can significantly enhance your social integration.

Utilize apps like Duolingo, Babbel, or Rosetta Stone for a flexible, user-friendly approach to language learning. Additionally, consider enrolling in language courses at local schools or universities, which offer classes from beginner to advanced levels.

Immersion is also key: practice Spanish in everyday situations such as shopping and dining. This regular practice will improve your fluency and help you feel more at home.

Social Norms and Etiquette

Understanding and adopting local customs can greatly ease your transition. In Spain, greetings often involve cheek kisses, even in semi-formal settings, and punctuality is treated with flexibility, with a little lateness often accepted in social contexts. Dining is a leisurely affair, with dinners typically starting around 9 PM or later.

Understanding Local Customs

The Spanish siesta is a famous aspect of daily life, with many businesses closing in the afternoon. Adjust your schedule accordingly for errands or appointments.

Engaging in local festivals, such as La Tomatina or Feria de Abril, also provides a wonderful opportunity to immerse yourself in Spanish culture and build connections with the community.

Navigating Bureaucracy and Building a Local Network

Spanish bureaucracy can be complex and slow. It is beneficial to seek local advice or assistance to navigate these processes more effectively. Additionally, building a local network can be crucial for your integration.

Participate in community activities or join local clubs that align with your interests. Expanding beyond the expat community by making local friends and connections enriches your living experience and aids in cultural integration. Expat groups can also offer support and guidance, proving invaluable in your initial adjustment period.

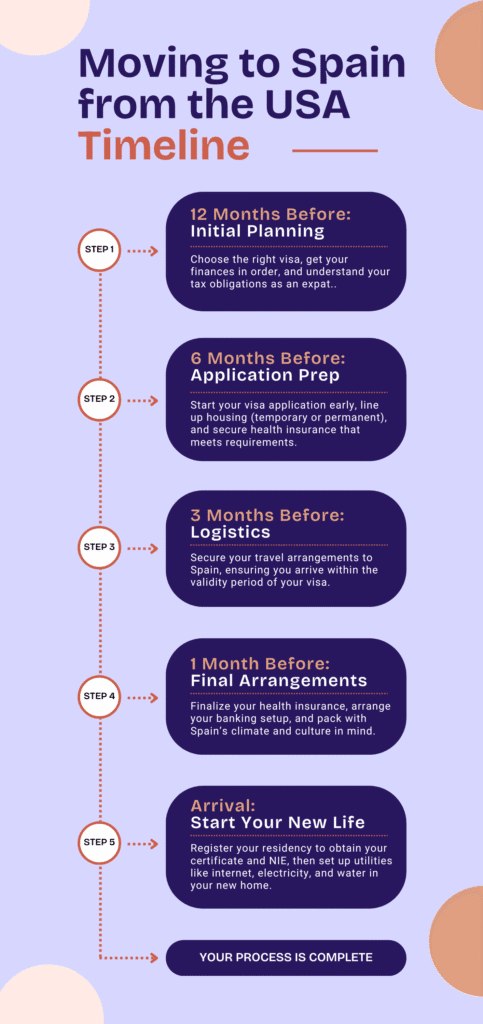

Moving to Spain from the USA Timeline

Preparing for a move to Spain from the USA requires careful planning and organization. Here’s a simplified timeline to guide you through the necessary steps from one year before your move to your arrival:

12 Months Before: Initial Planning

- Research Visas: Start by determining which type of visa suits your situation best. Understand the requirements and the application process.

- Finances: Begin organizing your financial matters. Consider how you’ll manage your money between the US and Spain.

- Taxes: Familiarize yourself with the tax implications for expats in Spain, including potential benefits under the US-Spain Tax Treaty.

6 Months Before: Application and Preparation

- Start Visa Application: Begin the formal application process for your chosen visa to ensure ample processing time. At this stage, it would be the perfect time to enlist the help of an experienced immigration lawyer, like those at Lexidy, to ensure your application is set up for success.

- Housing Search: Start looking for housing. Decide whether you want to rent or buy and whether you’ll secure a place to live before you arrive or initially stay in temporary accommodation.

- Acquire Health Insurance: Ensure you have appropriate health coverage as required by your visa and personal needs.

3 Months Before: Logistics

- Book Flights: Secure your travel arrangements to Spain, ensuring you arrive within the validity period of your visa.

1 Month Before: Final Arrangements

- Finalize Health Insurance: Ensure you have appropriate health coverage as required by your visa and personal needs.

- Bank Account: Set up a bank account if possible, or finalize how you will handle your banking when you arrive.

- Packing: Start packing, keeping in mind the climate, cultural norms, and your lifestyle in Spain.

Arrival: Establishing Your New Life

- Residency Registration: Register your residency at the local town hall and with the national police to obtain your residence certificate and finalize your NIE.

- Setting Up Utilities: Arrange for internet, electricity, water, and other essentials in your new home.

Ready to Move to Spain from the USA?

Moving to Spain from the USA offers a blend of vibrant culture, diverse environments, and high-quality healthcare, making it a top choice for Americans seeking a new life abroad. Whether you’re drawn to the dynamic cities or the relaxing countryside, Spain provides a welcoming setting with its warm climate and rich history.

As you prepare for this exciting transition, remember the importance of informed planning and expert advice. Consulting with legal experts or immigration professionals ensures that your move is smooth and tailored to your specific needs.

Whether you’re ready to move forward or just exploring your options, you’ll find everything you need on our Spain Immigration service page — or simply fill out the form below to speak with our team.