What if launching your startup in Europe came with fewer taxes, faster paperwork, and a visa tailored just for entrepreneurs? That’s exactly what Spain is aiming for. With the introduction of Law 28/2022, known as the Spain Startup Law, the country is signaling its ambition to become one of the world’s top destinations for innovation and high-growth businesses.

Spain’s Startup Law responds directly to global trends such as remote work, digital entrepreneurship, and the modernization of traditional economies. In force since 2023, it is designed to make starting up in Spain smoother, faster, and more competitive.

This guide breaks down exactly what the Spain startup law offers, who qualifies, and how founders from outside the EU can take advantage of it. If you’re planning to build a business in Europe, here’s what you need to know.

(Article Updated July 2025)

Table of Contents

- What Is the Spain Startup Law?

- What Qualifies as a Startup in Spain?

- Key Benefits Under Spain’s Startup Law

- Certification Process: ENISA and Ongoing Compliance

- Impact on Foreign Talent and Investment

- Common Questions About the Spain Startup Law

- How Lexidy Can Help You Launch Your Startup in Spain

- Need Support Navigating the Spain Startup Law?

What Is the Spain Startup Law?

Law 28/2022, known as the Spain Startup Law, is a legislative framework designed to make Spain one of Europe’s most attractive destinations for startups, remote workers, and digital entrepreneurs. It came into force in 2023 and introduced a wide set of reforms to foster innovation and simplify doing business in Spain.

The law responds to global trends like remote work, cross-border entrepreneurship, and the rise of digital business models. Its goal is to reduce red tape, modernize the tax environment, and build a legal structure tailored to early-stage, high-growth companies.

Key features include the formal definition of what qualifies as a startup in Spain, tax benefits for both companies and their employees, reforms to the Beckham Law, and the introduction of a Digital Nomad Visa for non-EU remote workers. Together, these measures aim to attract top talent and investment while building a thriving innovation ecosystem.

Need help understanding whether you benefit from the Spain Startup Law? Let our legal team guide you through each step.

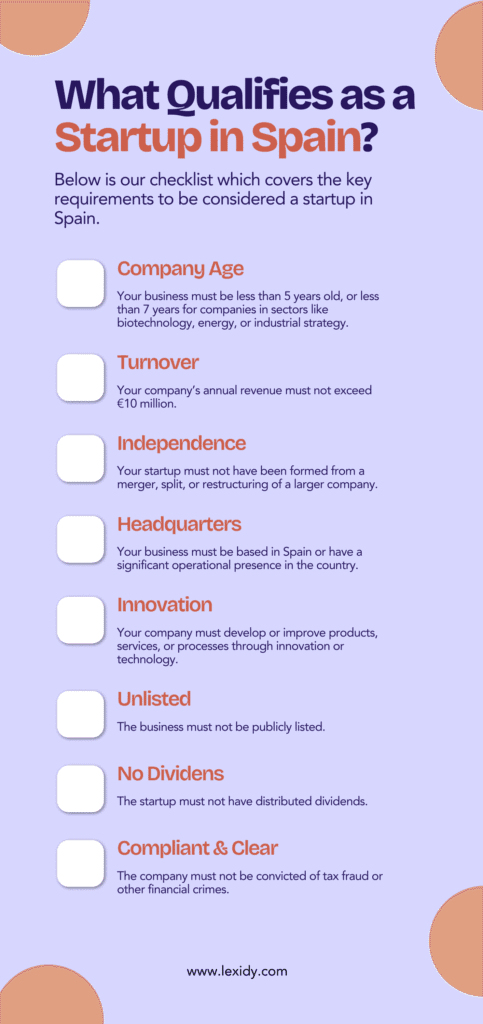

What Qualifies as a Startup in Spain?

To access the benefits of Spain’s Startup Law, companies must meet specific criteria set out in Law 28/2022. These requirements ensure that only early-stage, innovative businesses benefit from the legal and tax incentives. Eligibility is determined through certification by ENISA, Spain’s National Innovation Company.

Here’s what defines a qualifying startup:

- Company Age: The business must be less than 5 years old, or less than 7 years for companies in sectors like biotechnology, energy, or industrial strategy.

- Turnover: Annual revenue must not exceed €10 million.

- Independence: The startup must not have been formed from a merger, split, or restructuring of a larger company.

- Headquarters: The business must be based in Spain or have a significant operational presence in the country.

- Innovation: The company must develop or improve products, services, or processes through innovation or technology.

- Unlisted: The business must not be publicly listed.

- No Dividends: The startup must not have distributed dividends.

- Compliant and Clear: The company must not be convicted of tax fraud or other financial crimes.

To apply for certification, founders must submit documentation through ENISA. If the agency does not respond within three months, the company is automatically approved under the principle of positive administrative silence.

Key Benefits Under Spain’s Startup Law

Spain’s Startup Law introduces a series of financial, tax, and administrative benefits that make it easier for early-stage companies to grow. Here’s what qualifying startups can access:

| Area | Before Law 28/2022 | After Law 28/2022 (Spain Startup Law) |

| Corporate Tax Rate | 25% standard corporate tax for most businesses. | 15% reduced tax rate for startups (valid for the first profitable year + 4 years). |

| Tax Payment Deadlines | Corporate tax due in full with limited deferral options. | Startups can defer tax payments for 12 months in year one and 6 months in year two of profitability. |

| Stock Options | Exemption capped at €12,000 and taxed upon grant. | Exemption increased to €50,000 per year, with taxation deferred until liquidity event. |

| Investor Tax Deduction | Deduction of 30% on €60,000 per year. | Deduction increased to 50% on up to €100,000 invested annually in qualifying startups. |

| Beckham Law | Limited scope and less clarity. | Expanded eligibility for startup employees; 24% flat rate on income earned in Spain (not freelancers). |

| Company Formation | Higher share capital required. Notary and registry fees applied. | Incorporation possible with €1 share capital if following the CIRCE process. Digital one-stop shop streamlines the process with reduced notary and registry fees. |

| Social Security Contributions | Founders with another job had to contribute twice. | Founders with salaried positions elsewhere are exempt from double social security contributions. |

Reduced Corporate Tax Rate

Certified startups benefit from a 15% corporate tax rate for up to four years with profit, compared to the standard 25%. This lower rate helps founders reinvest earnings into growth and operations.

Flexible Tax Payment Deadlines

Startups can defer corporate income tax payments for the first two years of profitability. The deferral lasts 12 months in the first year and 6 months in the second, offering extra breathing room during the early stages.

Improved Stock Option Tax Treatment

The law increases the exemption for employee stock options from €12,000 to €50,000 annually, and defers taxation until a liquidity event (such as a sale or IPO). This makes it easier for startups to attract and retain top talent.

Higher Tax Deductions for Investors

Private investors can deduct 50% of their investment in a qualifying startup, up to €100,000 per year. This makes early-stage startups more attractive to angel investors and seed funds.

Broader Access to the Beckham Law

More startup employees and foreign founders can now access the Beckham Law, which applies a flat 24% personal income tax rate on Spanish-source income for up to six years. This can result in significant savings, especially for high earners.

Simplified Company Formation

Startups can now incorporate with just €1 in share capital, and the process is streamlined with reduced notary and registry fees when using the government’s digital one-stop platform (CIRCE).

No Double Social Security Contributions

Founders who keep a salaried position elsewhere in Spain are exempt from paying social security twice, which reduces costs and simplifies compliance.

Want to avoid costly mistakes? Get legal clarity on launching a startup in Spain.

Certification Process: ENISA and Ongoing Compliance

To access Startup Law benefits in Spain, companies must first be certified by ENISA (Empresa Nacional de Innovación), confirming they meet the requirements under Law 28/2022.

Applicants must show:

- An innovative, scalable business model

- A qualified founding team

- A clear growth and financing strategy

- Operations in Spain or a strong local presence

Certification is required before applying for any tax or immigration benefits. While the checklist seems objective, ENISA applies subjective criteria, especially around innovation and scalability. Applications may be rejected even if formal requirements are met. A strong business plan and compelling innovation narrative are crucial.

To prevent delays, the law includes positive administrative silence. If ENISA doesn’t respond within three months, certification is granted automatically.

Once certified, startups must stay compliant with tax and labor rules and continue meeting innovation criteria. ENISA may conduct periodic reviews to confirm eligibility.

Impact on Foreign Talent and Investment

Spain’s Startup Law aims to attract international founders, investors, and digital workers by removing common barriers to entry.

The Digital Nomad Visa allows non-EU nationals to live and work remotely in Spain for up to 5 years, with a path to permanent residency. It’s a key tool for welcoming location-independent professionals.

Foreign investors now benefit from simplified ID requirements. They can register investments using a NIF (Tax ID) instead of a NIE, streamlining the process of contributing capital or buying shares.

The Beckham Law also remains in effect, offering eligible foreign professionals a 24% flat tax rate on Spanish income for up to six years, significantly reducing personal tax burdens for founders and key hires.

Previously, the law only applied to employees and limited company ownership to 24%. However, under the new Startup Law, company directors can now also qualify, and the shareholding cap no longer applies.

Together, these measures make Spain more accessible and attractive for global talent and startup investors.

Common Questions About the Spain Startup Law

Can non-EU citizens qualify as startup founders in Spain?

Yes. The law is open to non-EU founders, provided their startup is registered in Spain and meets the eligibility criteria and receives ENISA certification.

Do I need to live in Spain to apply?

Not necessarily. However, if you’re applying for residency benefits (like the Entrepreneur Visa), you’ll need to reside in Spain for part of the year.

How long does the ENISA certification process take?

ENISA aims to issue a decision within 3 months. If no decision is made within this period, the company is automatically approved through a mechanism called “positive administrative silence.”

What if my startup has remote employees based outside Spain?

That’s allowed, but most employees should be based in Spain. The key requirement is that the company maintains operational presence and core activity within the country.

Is there a minimum investment or capital requirement to qualify?

No specific minimum capital is required under the Startup Law, but your business plan should demonstrate growth potential and innovation.

Can I access the benefits without registering my company in Spain?

No. Your startup must be registered in Spain and certified by ENISA to unlock the benefits.

What happens if I no longer meet the requirements after certification?

You may lose access to the law’s benefits. Ongoing compliance with tax, labor, and innovation standards is required.

How Lexidy Can Help You Launch Your Startup in Spain

Expanding to Spain under the Startup Law requires more than just a business idea. From legal setup to certification and compliance, Lexidy supports entrepreneurs every step of the way with a tailored, startup-friendly approach.

Company Incorporation Made Simple

Lexidy’s legal team helps set up your business structure to align with Startup Law requirements. This includes choosing the right entity type, registering with Spanish authorities, and handling all administrative formalities.

ENISA Certification Support

Certification is essential to access the law’s benefits. Lexidy helps you prepare and submit your application to ENISA, ensuring your company meets the necessary criteria for innovation, scalability, and compliance.

Immigration Solutions for Founders and Teams

Whether you’re applying for Spain’s Digital Nomad Visa or relocating key team members, Lexidy provides immigration guidance that aligns with your business goals and residency plans.

Tax and Compliance Guidance

Startups must remain compliant with Spain’s tax, labor, and legal standards. Lexidy offers ongoing support to help your company stay on track—especially as it scales.

Looking to take the next step? Talk to a lawyer about how to launch your startup in Spain with confidence.

Need Support Navigating the Spain Startup Law?

Spain is no longer just a destination for sun and sangria—it’s stepping into the spotlight as a serious player in the global startup ecosystem. With the introduction of Law 28/2022, Spain’s Startup Law is actively reshaping how innovation thrives, offering real incentives for entrepreneurs who want to build bold ideas in Europe.

For international founders, remote-first companies, and digital talent, the law opens doors that were once closed. Simpler bureaucracy. Smarter tax incentives. Easier access to top-tier talent and a growing investor network.

If you’re thinking about your next move, Spain is making a strong case to be your startup’s future home. Start your company formation journey today! Speak with a lawyer who understands the Spanish startup landscape.

Fill out the form below to get started!