Dreaming of a seaside escape in Cascais? A rental in Lisbon’s buzzing center? Or a quiet retreat in the Algarve? For many international buyers, property in Portugal offers more than lifestyle; it’s also a smart investment. But before you commit, it’s crucial to understand property tax in Portugal for foreigners and how it can shape your costs and returns from day one.

Buying real estate abroad comes with layers of regulation, and Portugal is no exception. From one-time fees like IMT and Stamp Duty to recurring charges like IMI and AIMI, foreign buyers need clarity on what’s owed, when it’s due, and how to legally optimize their position.

This guide unpacks Portugal’s property tax landscape with clarity and confidence. We’ll cover what you’ll pay at closing, what to expect annually, and how to stay compliant and financially smart as a non-resident buyer.

(Article Updated August 2025)

Table of Contents

- Overview: Property Tax in Portugal for Foreigners

- Taxes When Buying Property in Portugal

- Annual Property Taxes in Portugal

- How to Pay Property Tax in Portugal

- Tax Benefits of Buying Property in Portugal

- Double Taxation & Residency Comparisons

- Frequently Asked Questions About Property Tax in Portugal for Foreigners

- Need Support With Your Property Tax in Portugal?

Overview: Property Tax in Portugal for Foreigners

When it comes to property tax in Portugal for foreigners, the same rules apply as for Portuguese citizens. If you’re investing from abroad, it’s important to understand how each tax works and when it is due.

There are four main taxes foreign buyers should know:

- IMT (Property Transfer Tax): Paid once at purchase, based on the property’s value, type, and use.

- Stamp Duty: A flat tax paid at the time of purchase, usually applied to the deed and mortgage documents.

- IMI (Municipal Tax): Charged annually by the local municipality, based on the property’s tax-assessed value.

- AIMI (Wealth Tax): An extra yearly tax on high-value property holdings.

Buyers should also factor in capital gains tax (when selling) and rental income tax (if leasing the property). While the tax system is consistent for locals and foreigners, how it impacts you can vary depending on residency status, double-taxation agreements, and property use.

Property tax in Portugal can be tricky for foreigners — get expert legal guidance for your property purchase in Portugal.

Taxes When Buying Property in Portugal

When buying real estate in Portugal, two key taxes apply at the time of purchase: IMT and Stamp Duty. These one-time costs can significantly affect your budget, so it’s important to understand how they’re calculated and what exemptions may apply.

IMT (Property Transfer Tax)

IMT is a tiered tax applied to the purchase price or tax-assessed value, whichever is higher. Rates depend on whether the property is a primary or secondary residence, located in mainland Portugal or the autonomous regions, and whether it’s urban or rural.

For urban residential properties in mainland Portugal, the 2025 IMT rates range from 1% to 7.5%, with a sliding scale applied in brackets. Properties valued over €1 million are taxed at a flat 7.5%.

New in 2025: First-time buyers under 35 may qualify for partial or full IMT exemptions when purchasing a primary residence under €316,772.

Stamp Duty (Imposto do Selo)

Stamp Duty is a flat 0.8% tax applied to the property’s purchase price, regardless of residency or purpose. If a mortgage is involved, an additional 0.6% stamp duty may apply to the loan amount.

Sample Cost Breakdown

Let’s say a foreign buyer purchases a €500,000 second home in Lisbon (without a mortgage):

| Cost Component | Rate | Estimated Amount |

| IMT | ~6% | €30,000 |

| Stamp Duty | 0.8% | €4,000 |

| Total Purchase Taxes | €34,000 |

These costs are typically due before or at the time the final deed is signed at the notary.

Other Costs to Expect at Closing

While not taxes, there are additional legal and administrative fees to account for when buying property in Portugal:

| Cost Type | Typical Range |

| Notary Fees | €600 – €1,000 |

| Land Registry | €250 – €750 |

| Legal Fees | Up to 1% of the purchase price |

| Mortgage Stamp Duty (if applicable) | 0.6% of loan amount |

These form part of your overall purchase budget and are usually paid during the final steps of the transaction.

Exploring real estate options in Portugal? Get legal support for your property purchase.

Annual Property Taxes in Portugal

Once the purchase is complete, property owners in Portugal are responsible for two ongoing taxes: IMI and, in some cases, AIMI. These are based on the property’s tax-assessed value (Valor Patrimonial Tributário or VPT), which is usually lower than the market price.

IMI (Municipal Property Tax)

IMI is an annual tax charged by the local municipality. Rates vary by region:

- Urban properties: 0.3% to 0.45%

- Rural properties: 0.8%

IMI Payment Calendar

| Annual IMI Amount | Payment Schedule |

| Up to €100 | One payment in May |

| €100.01 – €500 | Two payments: May and November |

| Over €500 | Three payments: May, August, and November |

Exemptions & Reductions

- Up to 3 years of exemption for primary residences under certain thresholds

- Reductions available for low-income households and energy-efficient properties

- Late payments may trigger interest, penalties, and collection action from tax authorities.

AIMI (Wealth Tax)

AIMI is an additional tax for individuals or entities with high-value property holdings in Portugal. It’s applied annually, based on the total VPT of all properties owned.

Who Pays and How Much?

- Individuals:

- Up to €600,000: Exempt

- €600,001–€1M: 0.7%

- €1M–€2M: 1%

- Over €2M: 1.5% (only on the amount above)

- Couples with joint ownership: Can opt for joint taxation, doubling the exemption to €1.2M.

- Companies: Taxed at 0.4% on all property value, with no exemption.

AIMI is assessed on January 1st and due in September each year.

Quick Example: If a single buyer owns a property with a VPT of €700,000, AIMI would apply to the €100,000 above the exemption, resulting in a tax of €700 for the year.

How to Pay Property Tax in Portugal

Paying property tax in Portugal as a foreigner is a straightforward process, but timing and accuracy matter. Both IMI and AIMI are collected by the Autoridade Tributária e Aduaneira (AT), Portugal’s national tax authority, and can be paid online or in person.

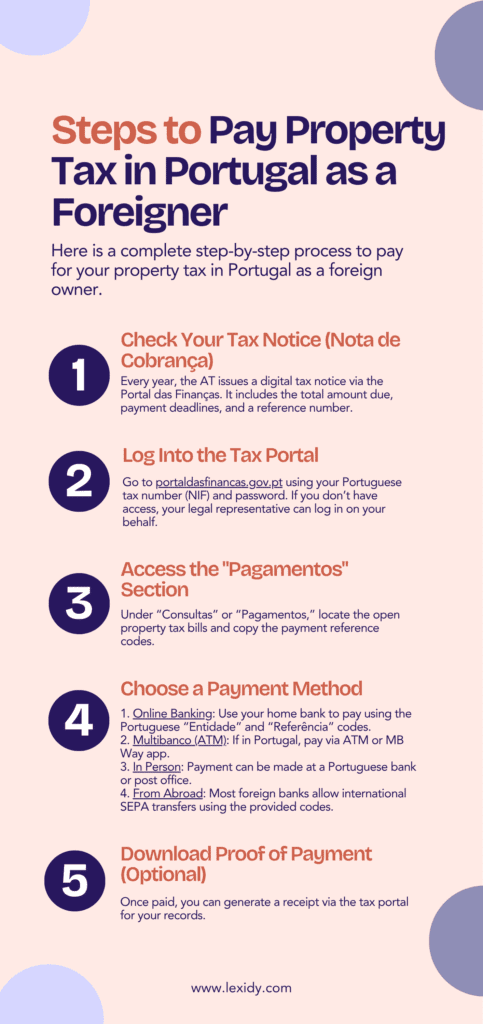

Step-by-Step: Paying IMI or AIMI

- Check Your Tax Notice (Nota de Cobrança): Every year, the AT issues a digital tax notice via the Portal das Finanças. It includes the total amount due, payment deadlines, and a reference number.

- Log Into the Tax Portal: Go to portaldasfinancas.gov.pt using your Portuguese tax number (NIF) and password. If you don’t have access, your legal representative can log in on your behalf.

- Access the “Pagamentos” Section: Under “Consultas” or “Pagamentos,” locate the open property tax bills and copy the payment reference codes.

- Choose a Payment Method:

- Online Banking: Use your home bank to pay using the Portuguese “Entidade” and “Referência” codes.

- Multibanco (ATM): If in Portugal, pay via ATM or MB Way app.

- In Person: Payment can be made at a Portuguese bank or post office.

- From Abroad: Most foreign banks allow international SEPA transfers using the provided codes.

- Download Proof of Payment (Optional): Once paid, you can generate a receipt via the tax portal for your records.

Deadlines and Penalties

IMI is due in May, and possibly also August and November, depending on the total amount (see calendar in Section 3).

AIMI is due in September, based on ownership as of January 1.

Late payments are subject to daily interest accrual, administrative fines, or enforcement action by the tax authority, including property liens in serious cases.

Tax Benefits of Buying Property in Portugal

While Portugal has several taxes tied to real estate, it also offers meaningful incentives that reduce your tax burden, especially if you’re a first-time buyer, renovating a property, or relocating to live full-time in Portugal.

IMT and Stamp Duty Exemptions

As of 2025, first-time buyers under age 35 may qualify for full or partial IMT exemptions when purchasing a primary residence valued under €316,772.

Some Stamp Duty relief may apply for low-income buyers or those purchasing subsidized housing, though this is less common for non-residents.

IMI Reductions and Exemptions

Foreigners who make their Portuguese property their primary residence may benefit from up to 3 years of IMI exemption, depending on value and eligibility.

Other IMI reductions may apply for:

- Energy-efficient homes (high EPC rating)

- Households considered low-income under Portuguese law

- Municipal programs offering targeted relief

Renovation and Sustainability Incentives

If the property is located in an Urban Rehabilitation Area (ARU) or is classified as needing restoration, buyers may be eligible for:

- IMT and IMI exemptions on the rehabilitated property

- Reduced 6% VAT on approved construction work

- Tax credits for upgrades that improve energy performance or structural safety

- Discounted notary and land registry fees in qualifying zones

Capital Gains Tax Deferral (If Reinvested)

Foreigners who later sell their Portuguese primary residence may be exempt from capital gains tax if they reinvest the proceeds into another EU-based primary home. This benefit is available to both residents and some qualifying non-residents.

Double Taxation & Residency Comparisons

One of the biggest concerns for international property buyers is paying taxes twice, once in Portugal and again in their home country. Fortunately, Portugal has Double Taxation Agreements (DTAs) with more than 70 countries, including the United States, United Kingdom, Canada, Australia and all EU member states.

How Double Taxation Agreements Work

DTAs ensure that income, gains, or property taxed in Portugal won’t be taxed again in your home country, or will be taxed at a reduced rate. In most cases, if you pay tax in Portugal on rental income or capital gains, your home country will give you a credit or exemption to prevent double taxation.

However, the exact relief depends on:

- Your country’s tax rules

- The type of income (e.g., rental vs gains)

- Whether you qualify as a Portuguese tax resident

Residency Types Compared

Here’s how tax obligations shift depending on your status in Portugal:

| Taxpayer Type | Portuguese-Sourced Rental Income | Capital Gains on Portuguese Property | Annual Property Taxes | Eligible for Tax Benefits? |

| Non-Resident | 28% flat tax (no deductions) | 28% flat tax | IMI, AIMI if applicable | Limited (some exemptions only) |

| Tax Resident | Taxed at progressive rates (14.5–48%) | Taxed at 50% of gain, progressive rate | IMI, AIMI if applicable | Yes (IMI, IMT, rehab perks) |

| NHR Resident | 28% on rental income (no special rate) | 28% on capital gains | IMI, AIMI if applicable | No extra perks, NHR ended 2024 |

Note: Portugal’s popular Non-Habitual Residency (NHR) regime ended for new applicants in 2024. Those already under the NHR regime retain benefits until their 10-year period expires.

Frequently Asked Questions About Property Tax in Portugal for Foreigners

Do foreigners pay more tax?

No. Foreigners and Portuguese citizens are subject to the same property tax framework. However, non-residents are usually taxed at a flat 28% on rental income and capital gains, without deductions, unlike residents, who may be taxed progressively with allowances.

Can I pay property taxes in Portugal from abroad?

Yes. Property taxes like IMI and AIMI can be paid from outside Portugal using:

- International bank transfers

- Online banking (via reference codes)

- A legal representative or tax advisor with access to your Portal das Finanças account

What happens if I miss a payment?

Late property tax payments trigger:

- Interest charges (calculated daily)

- Administrative fines

- In severe cases, enforcement actions like property liens by the Portuguese Tax Authority

To avoid issues, always monitor your tax notices and set payment reminders, especially if you don’t live in Portugal full-time.

Are there hidden fees I should expect?

Not exactly, but there are non-tax costs that buyers often overlook, including:

- Notary and registration fees

- Legal representation (typically 1–2% of the purchase price)

- Mortgage stamp duty (0.6%, if financing)

These aren’t hidden, but they do add up. Plan to budget an extra 10–12% on top of the property’s price.

Can I recover any of these taxes when I sell the property?

Not directly. However, capital gains tax is only applied on the profit from the sale. You can deduct some allowable costs like:

- Renovation expenses

- Notary and legal fees

- IMT and Stamp Duty paid during purchase

For residents, reinvesting the gains into another primary residence in Portugal or the EU may exempt you from capital gains tax altogether.

Need Support With Your Property Tax in Portugal?

Buying property in Portugal can unlock a lifestyle upgrade, a strong investment, or both. But before signing on the dotted line, understanding property tax in Portugal for foreigners is essential. From one-time purchase costs to annual obligations and tax-saving opportunities, getting the details right can help you avoid costly mistakes and make smarter financial decisions.

Whether you’re planning to buy a seaside villa, a city apartment, or a rural fixer-upper, expert legal and tax support will make the process easier, safer, and more profitable.

Need help navigating Portugal’s property tax system? Get clarity on your tax obligations with expert legal support. Fill out the form below to get started!